- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes, and it is easier to do.

Form 1099-INT reports interest from banks, brokerages, and other financial institutions. Here's how to enter a 1099-INT:

- Open (continue) your return if it's not already open.

- Inside TurboTax, search for 1099-INT and select the Jump to link in the search results.

- Answer Yes to Did you receive any interest income?

- If you see Here's the interest we have so far, select Add interest income.

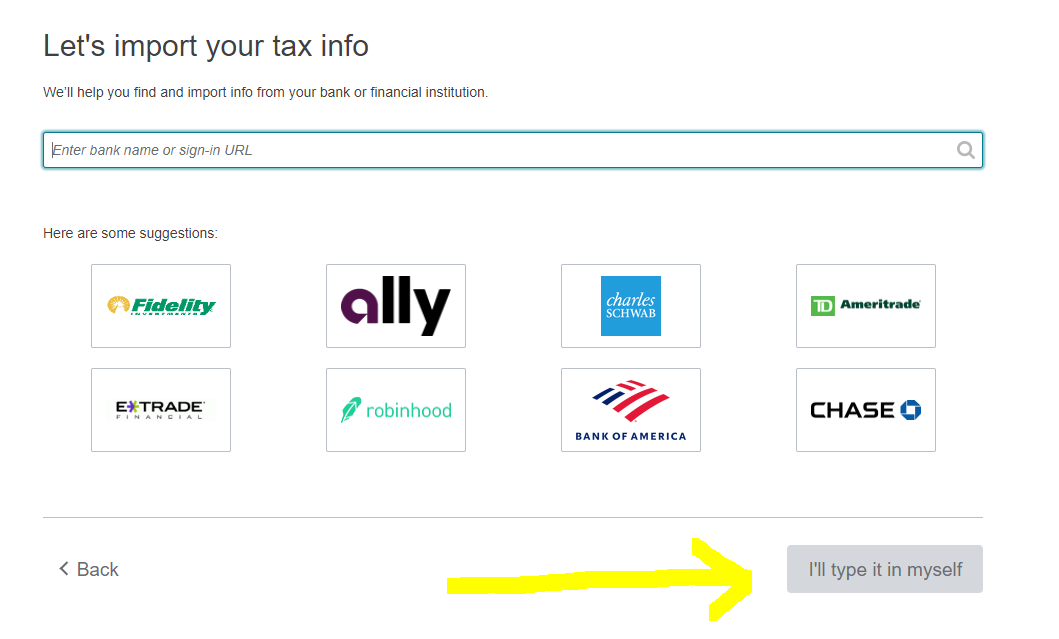

- On the following screen, select how you want to enter your 1099-INT (import or type it in yourself) and follow the on-screen instructions.

Related Information:

- What if I didn't get a 1099-INT from my bank?

- Do I need to report my child's 1099-INT on my 2019 return?

There is a button at the bottom that says ''I'll type it in manually''

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

July 13, 2020

9:04 PM