- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

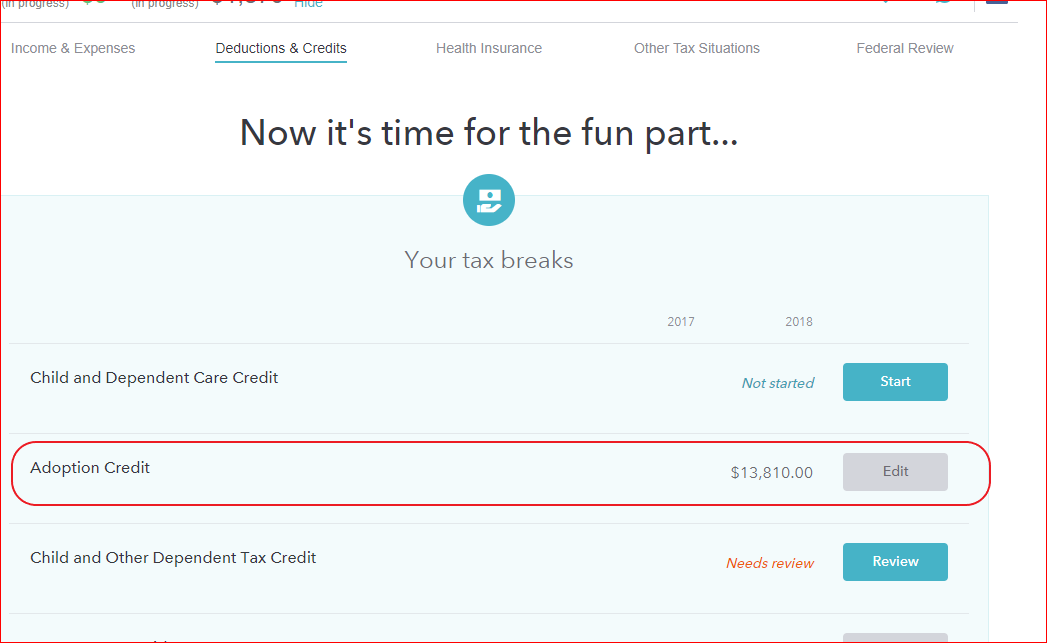

What you describe is not correct.You should be able to claim the $13840 tax credit in 2018, and carry forward any part of that amount that is unused in 2018 to next year's tax. You are not allowed to carry forward amounts in excess of $13840, the total credit allowed.

When you say that your "current income taxable amount is about $16,000" do you mean that's your taxable income (before you enter your medical and charity expenses) or is that your total income tax?

When I enter adoption expenses of $4000 for 2017, and $14,000 for 2018 (the year of adoption) I get an allowable credit of $13,840, which shows under Your Tax Breaks under Deductions & Credits. Where are you seeing that you are allowed the full $18,000 as an adoption credit?

**Mark the post that answers your question by clicking on "Mark as Best Answer"