- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

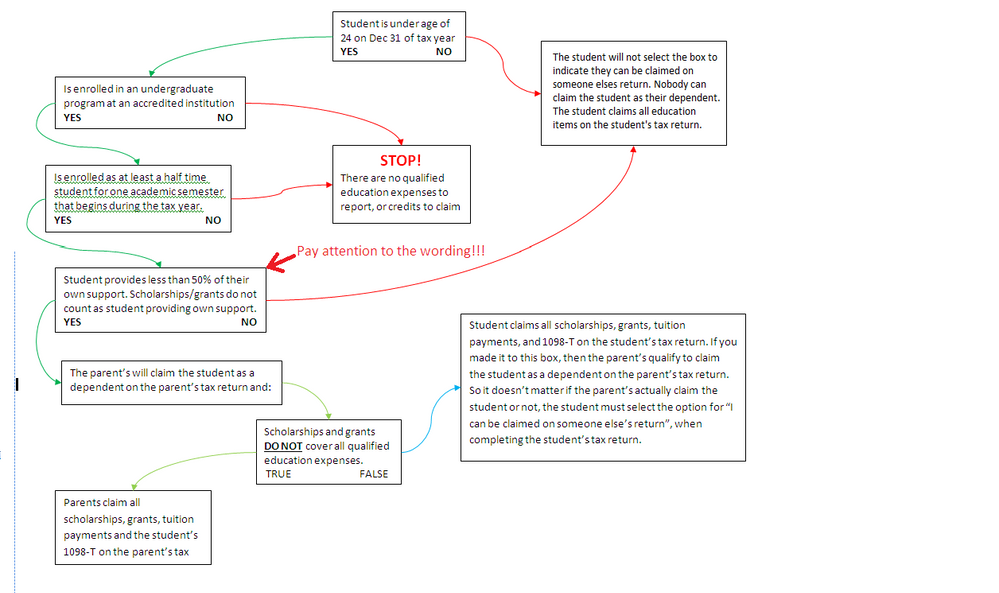

If it's true that box 5 of the 1098-T is about double or more the amount in box 1, then the parents don't need to bother reporting the 1098-T or *any* of the education stuff on the parents' tax return. The parent's will not qualify for any education tax breaks anyway. But the parent's will still claim the student as their dependent, and that's it.

If the student's earned income, when added to the taxable portion of the scholarship income is less than $12,300, then there is no requirement for the student to even file a tax return at all. However, if the student had any taxes withheld from their W-2 income, then the only reason to file a tax return with less than $12,300 of income, would be for the student to get those withheld taxes reported in box 2 of their W-2, refunded back to them.