- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to let TT not use QBI duduction on schedule K-1 (Form 1065) income?

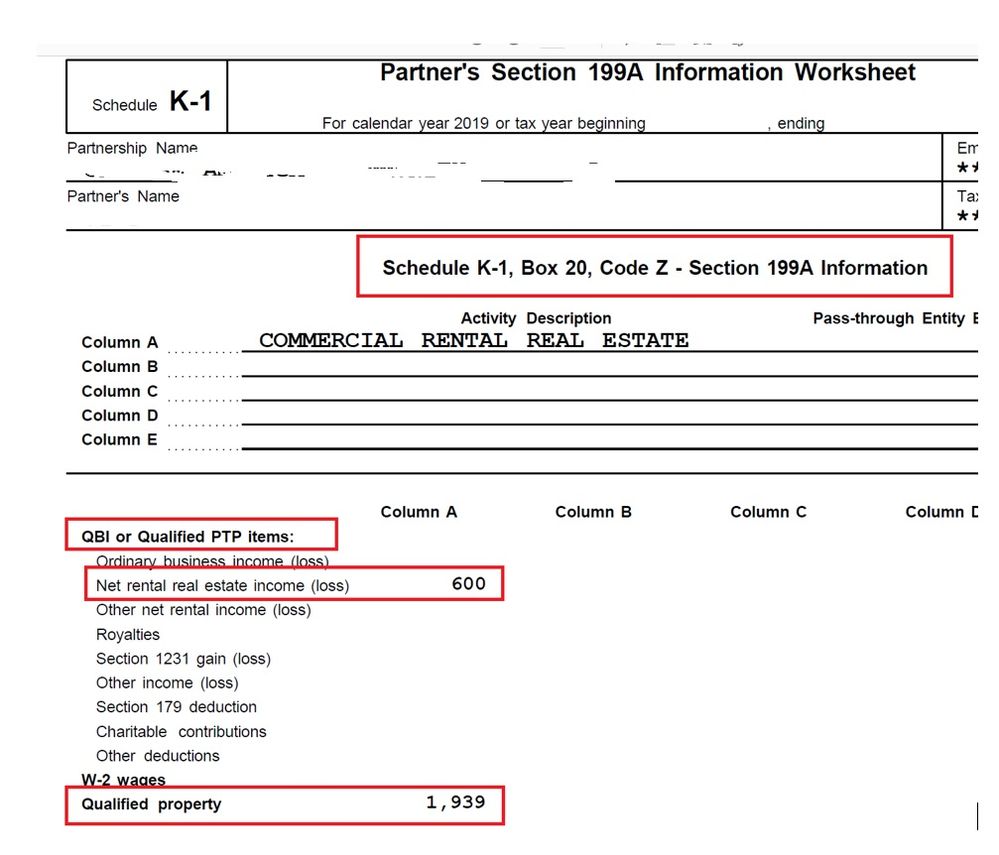

I received K-1 form and there is $600 rental income and $1,939 qualified property.

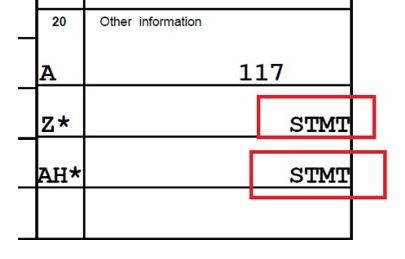

In box20, it has code Z and Code AH, but the amount of Z and AH were marked as 'STMT'. I don't not what it means, and TT doesn't allow me enter 'STMT' and a number is required.

I also received "Partner's Section 199A Information Worksheet" for Code Z.

I was told by the CPA who prepared for this K-1 form that these rental real estate income won't be eligible for QBI deduction for 2019.

So when I entered $2,539 ($600 + $1,939) for Code Z in TT, it automatically applied 20% deduction for me, so that I need to enter $0 for Code Z in TT in order not to let TT use QBI deduction?

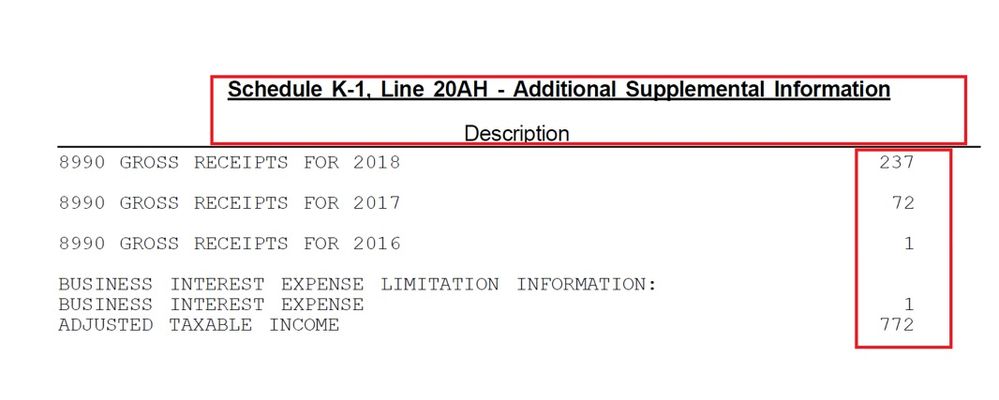

BTW, should I enter the value of Code AH $1,083 ($237 + $72 +$1 +$1 +$772) in TT?

February 27, 2020

11:04 AM