- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to let TT not use QBI duduction on schedule K-1 (Form 1065) income?

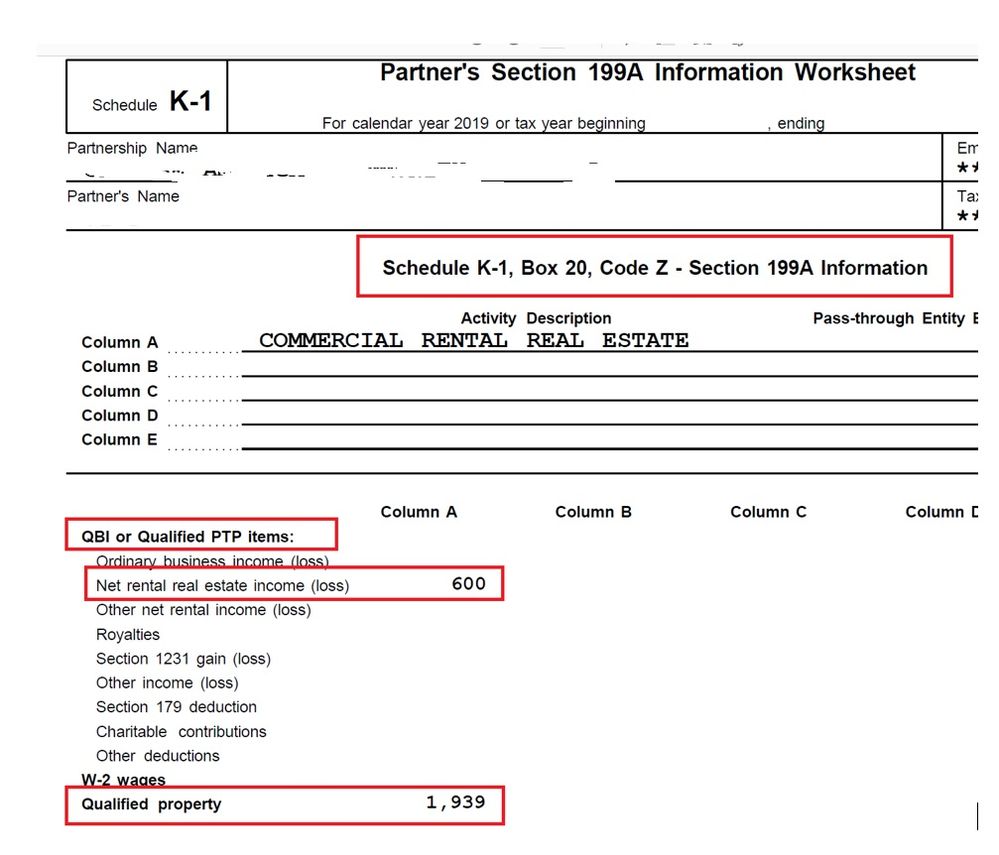

I received K-1 form and there is $600 rental income and $1,939 qualified property.

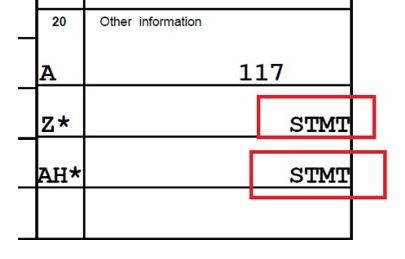

In box20, it has code Z and Code AH, but the amount of Z and AH were marked as 'STMT'. I don't not what it means, and TT doesn't allow me enter 'STMT' and a number is required.

I also received "Partner's Section 199A Information Worksheet" for Code Z.

I was told by the CPA who prepared for this K-1 form that these rental real estate income won't be eligible for QBI deduction for 2019.

So when I entered $2,539 ($600 + $1,939) for Code Z in TT, it automatically applied 20% deduction for me, so that I need to enter $0 for Code Z in TT in order not to let TT use QBI deduction?

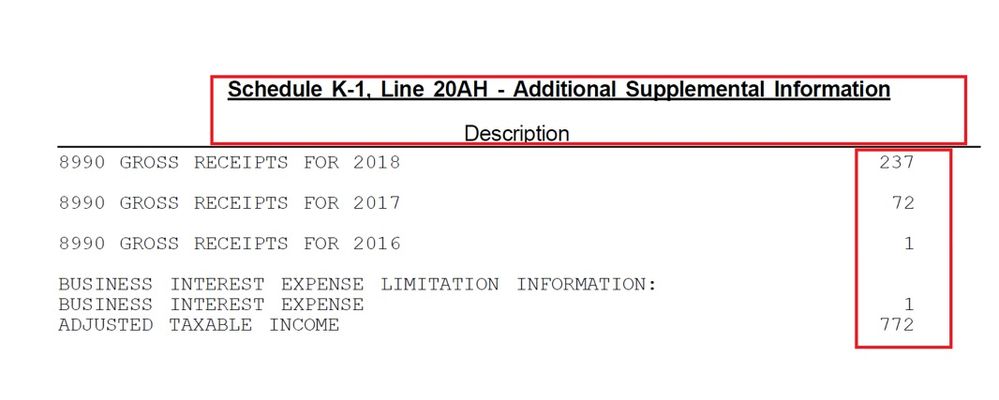

BTW, should I enter the value of Code AH $1,083 ($237 + $72 +$1 +$1 +$772) in TT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If you do not qualify for the QBID, just leave the Code Z amount off.

The AH amounts are for 8990 Gross Receipts for 2016,17,18. This is for the Limitation on Business Interest Expense Under Section 163(j). The amount of any business interest expense that is not allowed as a deduction under section 163(j) for the tax year is carried forward to the following year as a disallowed business interest expense carryforward until you are able to use it.

[ Edited 2/29/2020 | 6:13 PST ]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Just try to clarify , when you say 'keep the code z amount off, you mean enter 0 for the code z ? Or even do not type code z in box 20 in Turbo tax?

If entering 0, I will be asked to enter detailed figures of each line for code Z. In this case, what should I enter ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Just leave the Code Z off the Box 20 so you do not get the follow up questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"