- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

US citizen (in the US) married to a non-resident alien spouse who is not living in the US, does she need an ITIN number?

I'm a US citizen living in the US and am married to a non-resident alien (visa application is pending) who is not living in the US. My wife has never made US income.

In the last few years, I have filed as "Married Filing Separately" and was able to put a default tax number or write "NRA" for my wife where the form requested, but I am reading conflicting information online about what is accepted now.

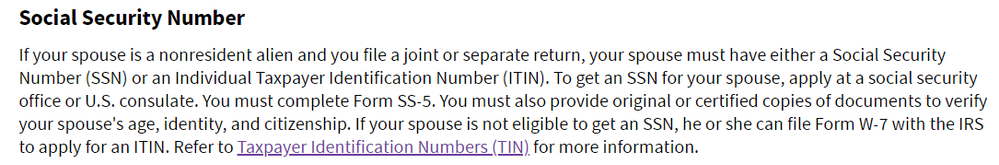

According to the IRS website here, my wife needs to file for an ITIN number (see screenshot below): https://www.irs.gov/individuals/international-taxpayers/nonresi[product key removed]e

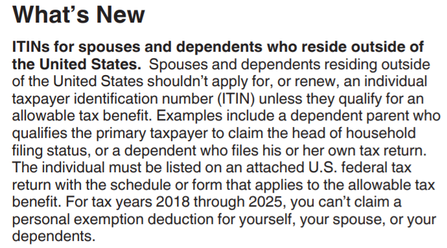

However, according to the instructions sheet for the W-7 ITIN application also at the IRS website, "spouses who reside outside of the US shouldn't apply for...an ITIN number unless they qualify for an allowable tax benefit." (See screenshot below): https://www.irs.gov/pub/irs-pdf/iw7.pdf

Do I need to fill out an application for an ITIN number or is there an option to put a default number/write "NRA" in the blank again? Because my wife's visa application is still pending, I don't want to do anything that would compromise the process.

Any help is appreciated.

February 12, 2020

7:12 PM