- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You can now enter 2025Social Security income information from Form 1099SM into Wages & Income, under Social Security (SSA-1099, RRB-1099).

Navigate to Wages & Income, then select Retirement Plans and Social Security.

Form SSA-1099-SM (Social Security Benefit Statement) is a tax document sent in January reporting total Social Security benefits received, including retirement, survivor, or disability, used to calculate taxable income. The "SM" indicates it is a self-mailer version of Form SSA-1099. Enter the amount in Box 5 (net benefits) as income for tax filing.

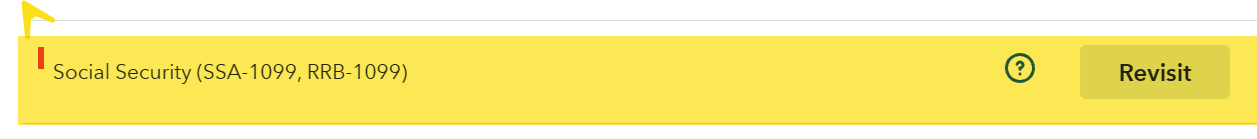

When you see "Revisit" in gray next to an item, this just indicates that the area has already been opened before. Click on "Revisit" to change information already entered. Items not yet started will have a "Start" button instead. See screenshot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"