- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Please see this thread from DanaB27 that lays out the steps you need to take to report this on your amended return.

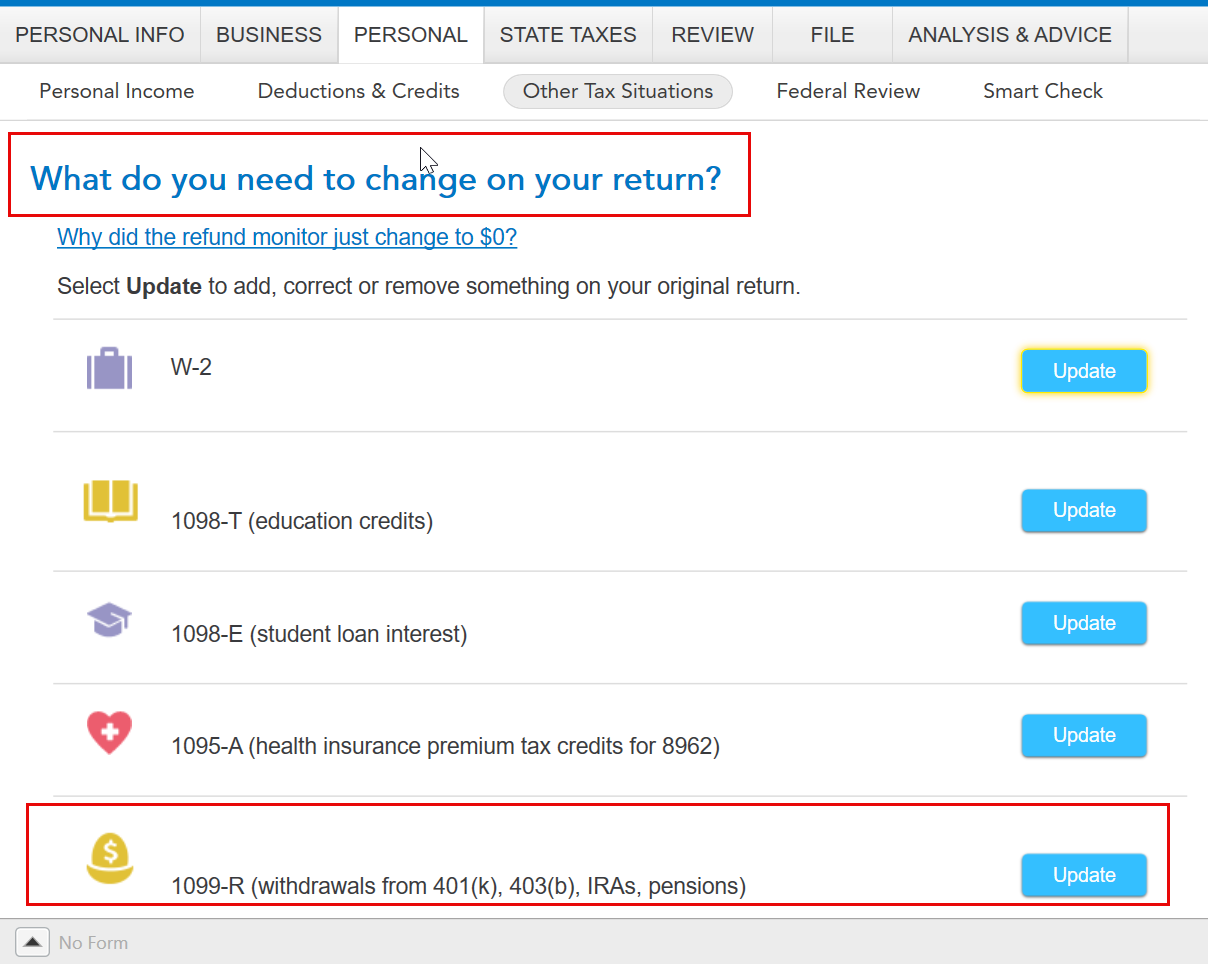

The entry point would be under the amended menu in Other Tax Situations. You will need to select update to the right of the section titled 1099-R (withdrawals from 401(k), 403(b), IRAs, pensions).

You will then be able to follow the steps in the link above to report the penalty on the excess contributions.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

May 22, 2025

9:33 AM