- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The IRS will not charge you an underpayment penalty if the following is met:

- You pay at least 90% of the tax you owe for the current year, or 100% of the tax you owe for the previous tax year, or

- You owe less than $1,000 in tax after subtracting withholdings and credits

For high-income taxpayers, the rule is slightly different. If the Adjusted Gross Income on your previous year’s return is over $150,000 (over $75,000 if you are married filing separately), you must pay the lower of 90% of the tax shown on the current year’s return or 110% of the tax shown on the return for the previous year.

Your state will also have their own estimated tax payment rules that may differ from the federal rules.

If you didn't pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. You may be able to avoid the penalty if you meet certain requirements.

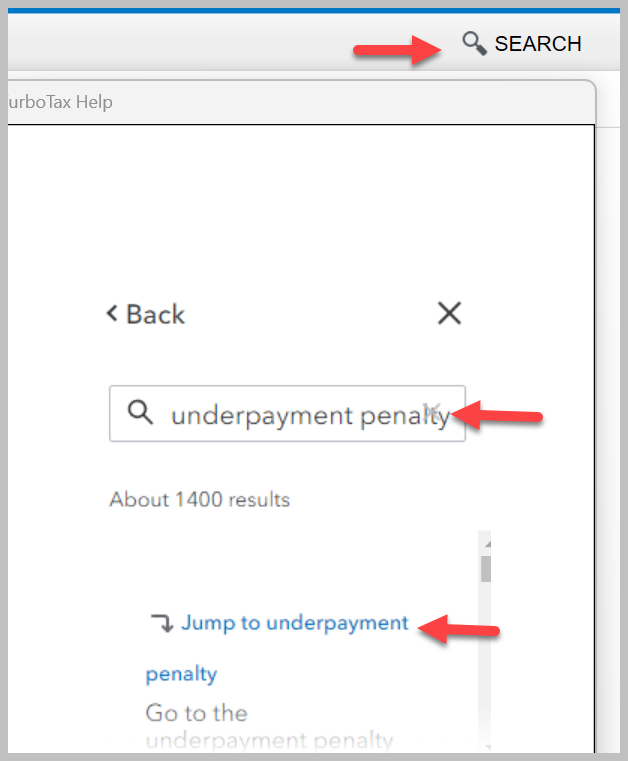

You can get to these screens in TurboTax as follows:

- Click on the search icon at the upper right of your TurboTax screen

- Type "underpayment penalty"

- Click on the link "Jump to underpayment penalty"

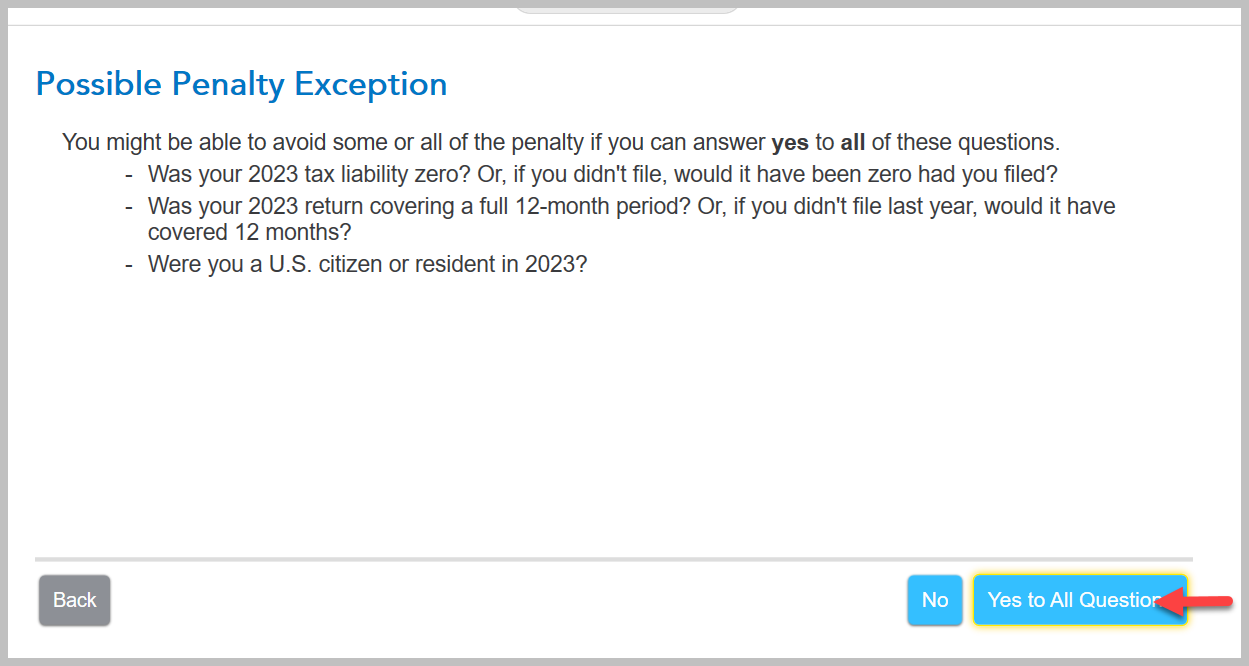

- If you can answer yes to all three questions you may be able to avoid some or all of your penalties.

Your screens will look something like this:

Click here for information on entering your estimated tax payments.

Click here for Estimated Taxes: How to Determine What to Pay and When

Click here for Underpayment of estimated tax by individuals penalty

**Mark the post that answers your question by clicking on "Mark as Best Answer"