- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You can prepare a deceased return in TurboTax. If you are using TurboTax Online it will have to be done under a separate TurboTax account. You can have up to five TurboTax accounts for one email.

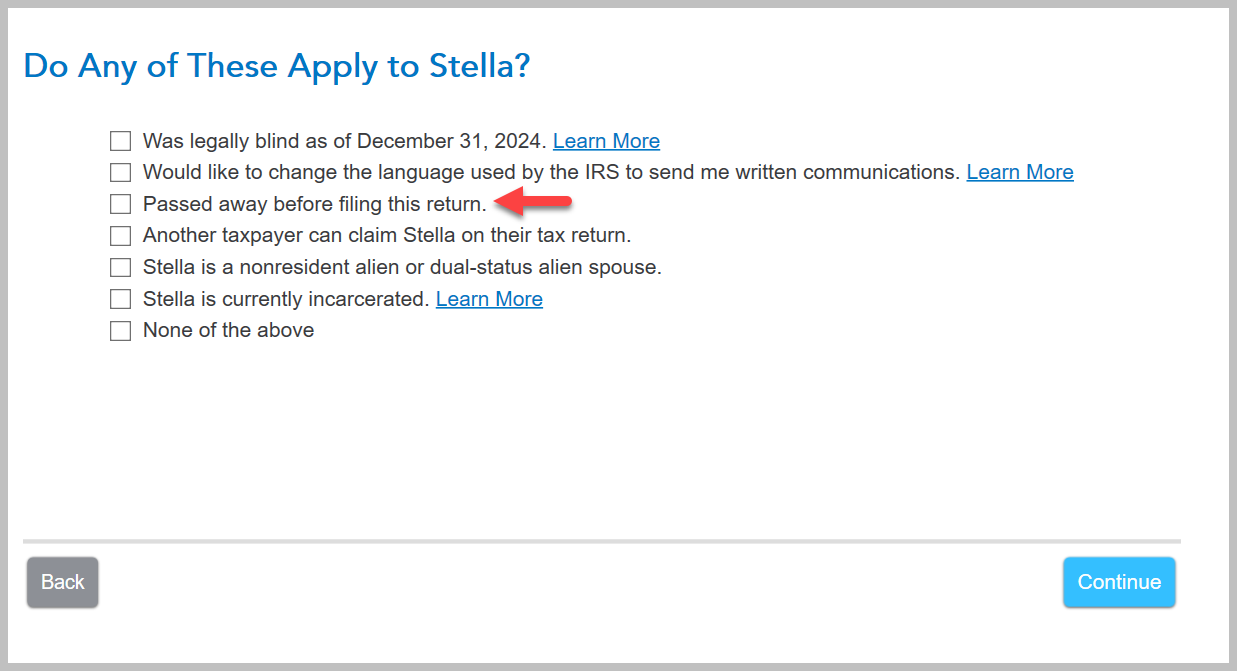

You will prepare it somewhat like you would prepare your own tax return. On the final tax return, the surviving spouse or representative should note that the person has died. You can do this after you enter the person's personal information by checking the box in TurboTax that says "Passed away before filing this return."

The IRS does allow tax returns for deceased taxpayers (also called decedent returns) to be e-filed.

You'll file a normal federal and state tax return for the deceased person based on their income and deductions until the date of their death (also called a decedent return).

Before you file a decedent's return, make sure the Social Security Administration has been notified of the taxpayer's death. You can either go to their website or call 1-800-772-1213.

To indicate in TurboTax that you are filing for a deceased person check the box that says "Passed away before filing this return"

Click here for Death in the Family

Click here for Can I e-file a tax return for someone who is deceased?

Click here for What forms will I need when filing a tax return for someone who's deceased?

Click here for Filing a final federal tax return for someone who has died

**Mark the post that answers your question by clicking on "Mark as Best Answer"