- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Follow these steps as you go through the program:

- Open to PA

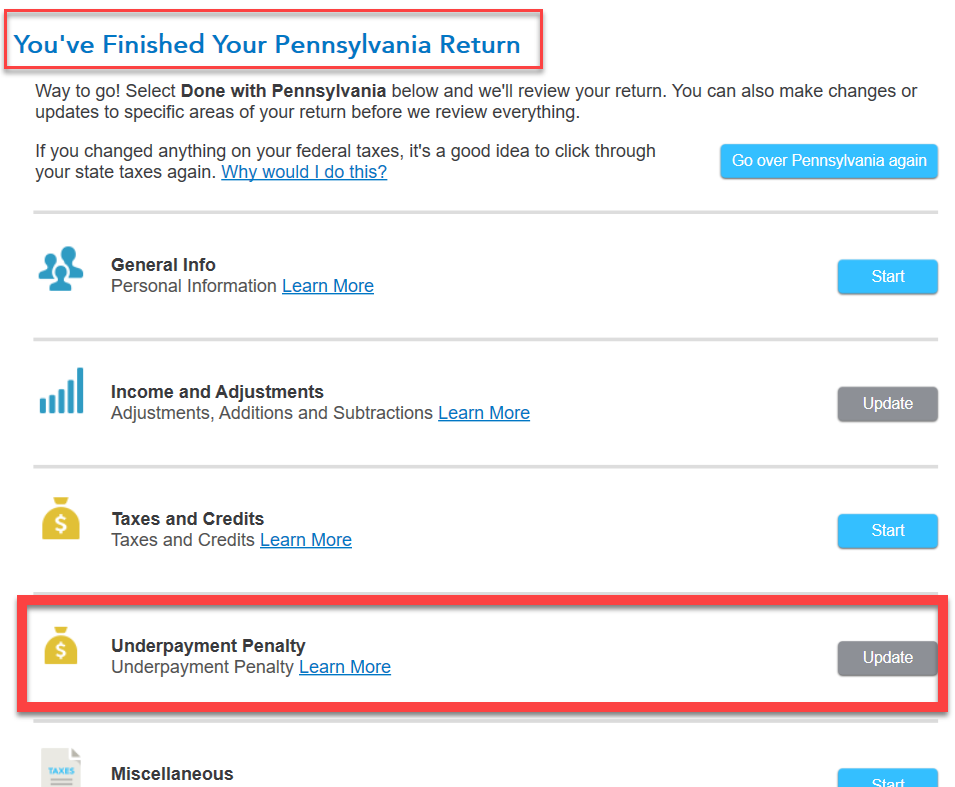

- Go through, you will probably come to You've Finished Your PA return.

- Locate the Underpayment Penalty

- Edit/ start/ update

- Let's have PA calculate the penalty, select NO

- Date tax will be paid, continue

- Enter PA income 2023 and 2023 tax liability

- Select if part year or didn't file in 2023, continue

The program will determine if you paid in the required amount based on 2023 income and liability.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 7, 2025

3:25 PM