- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Your 1099-INT box 3 shows interest on US Savings Bonds, Treasury bills, bonds, notes. Interest on US Obligations is not taxable at the state level but is taxable on your federal. This income is not included in box 1.

Your 1099-DIV

box 1a shows ordinary dividends. This income is taxable to the federal but may not all be taxable to the state. Your supplemental pages will show if you have US Obligations in box 1. In that case:

- on the next screen uncommon situation

- select a portion is US Government interest.

- Continue.

- Then enter the interest.

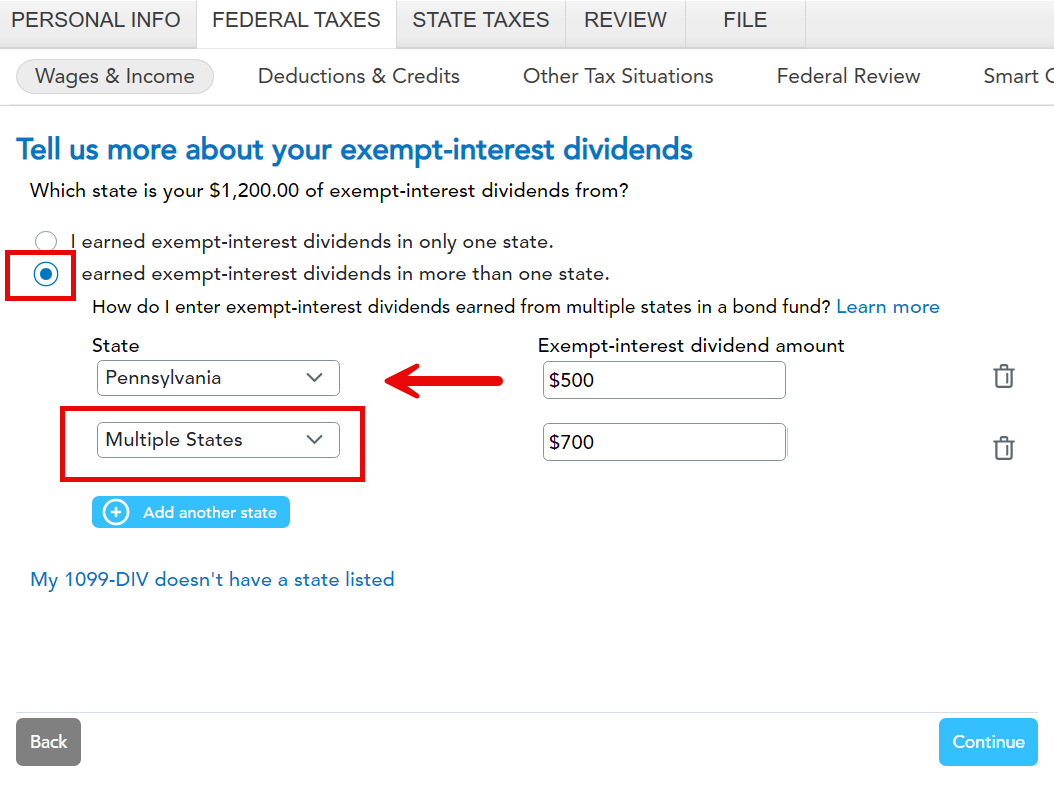

box 12 shows exempt interest from dividends or other Regulated Investment Company (RIC). This income is not taxable to the federal and may not be taxable to your state.

There should be a guide showing the percentage from your state. If a portion isn't taxable to your state, enter the income for your state. If you lived in more than one state, continue adding states. The last option is multiple states for the rest of the income.

You should not be changing your 1099-INT and 1099-DIV form entry but you should be allocating the amounts in the program.

[Edited 4/1/2025 | 8:27 am PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"