- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes, if you file a Section 266 Election to Capitalize Carrying Costs for the land, you may add loan interest, property taxes, and other carrying costs to the basis of the land. Closing costs for the original purchase are included in the original basis for the property (no election necessary). Closing costs for the sale are reported as "selling expenses" when you report the sale in TurboTax.

TurboTax does not include a Section 266 election, but you can complete a blank form to mail to the IRS. This form is available in TurboTax for Desktop or TurboTax Business only. Note this is an annual election that must be filed each year you make the election. Mail to the IRS address on the filing instructions included with your TurboTax return.

Click the Forms icon in the TurboTax header. In the left column, click Open Form, then type in "blank form." Click on the form to open it in the large window. You can now type in the statement you need to include with your return.

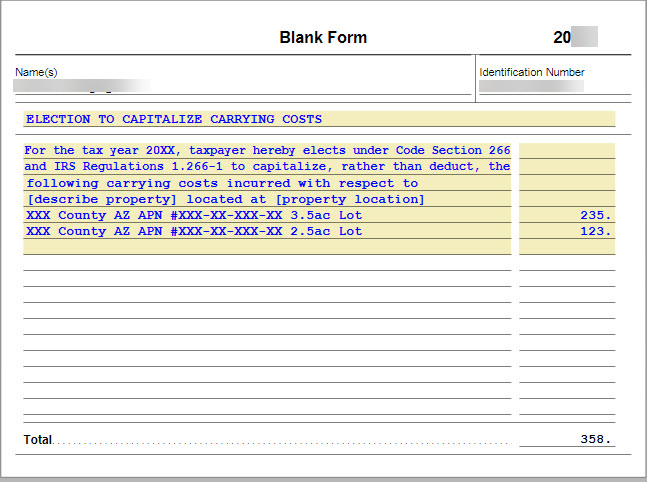

Example for capitalizing property taxes (form lines are not numbered:(

Line 1: ELECTION TO CAPITALIZE CARRYING COSTS

Line 2: For the tax year 20XX, taxpayer hereby elects under Code Section 266

Line 3: and IRS Regulations 1.266-1 to capitalize, rather than deduct, the

Line 4: following carrying costs incurred with respect to

Line 5: [describe property] located at [property location]

Line 6: XXX County AZ APN #XXX-XX-XXX-XX 3.5ac Lot

Line 6, column 2: $235 (rounded)

Line 7: XXX County AZ APN #XXX-XX-XXX-XX 2.5ac Lot

Line 7, column 2: $123 (rounded)

**Mark the post that answers your question by clicking on "Mark as Best Answer"