- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

CA and OR are very different in the way taxes are done and you are on a learning curve. For the OR return:

- you will select part year

- see a screen to make adjustments for the OR income.

- The screen will show your forms of income so you can determine how much was made in OR.

- You may get dividends quarterly and your Social Security monthly. Divide up the numbers to show the OR portion.

- After that you can go through the OR taxes and credits.

For the CA return:

- You will enter part year resident and the dates

- You will go through all the screens you are used to seeing

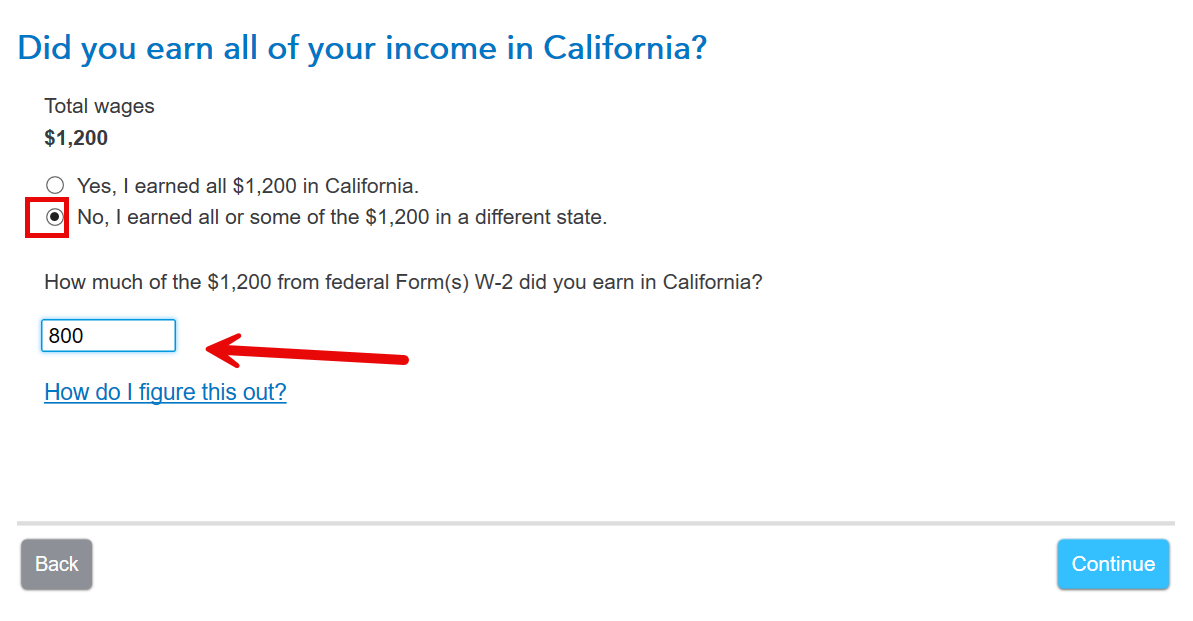

- Nonresident adjustments screen and series of questions, answer all and adjust amounts as needed.

You've got this and we are here to help!

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 18, 2025

7:54 PM