- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

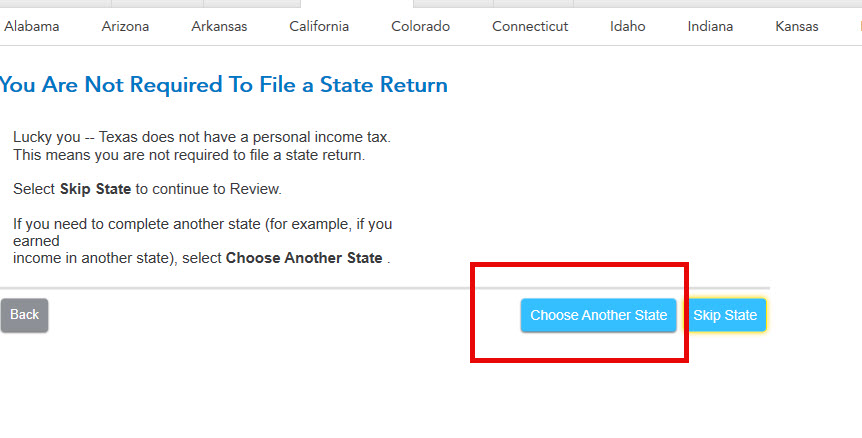

For the Desktop versions, you can select the "State Tax" tab on the top of the home screen. If you reported that you lived in both California and Oregon, the software will suggest you file for those states. If the program doesn't suggest one or the other, you can select "Choose Another State" to generate the state you want.

First you will fill in everything for the Federal return.

You will then do a Part-Year Resident state return for California and a Part-Year Resident state return for Oregon.

Since you moved from California to Oregon, do the California return first.

TurboTax will ask you to allocate your income between the two states.

Allocate the amount of pension and Social Security by what was received while living in each state.

If you have TurboTax Desktop, you can start right now.

**Mark the post that answers your question by clicking on "Mark as Best Answer"