- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

federal tax return rejected

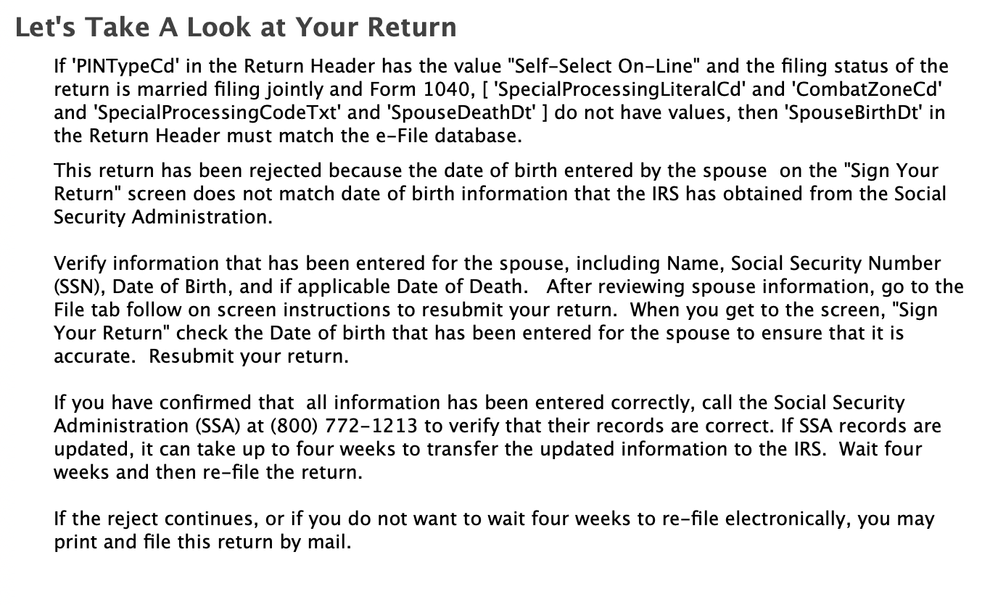

received the following error. How do I fix it? Information is accurate, but my federal tax return keeps getting rejected.

F1040-526-03 - If 'PINTypeCd' in the Return Header has the value "Self-Select On-Line" and the filing status of the return is married filing jointly and Form 1040, [ 'SpecialProcessingLiteralCd' and 'CombatZoneCd' and 'SpecialProcessingCodeTxt' and 'SpouseDeathDt' ] do not have values, then 'SpouseBirthDt' in the Return Header must match the e-File database.

March 11, 2025

2:26 PM