- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

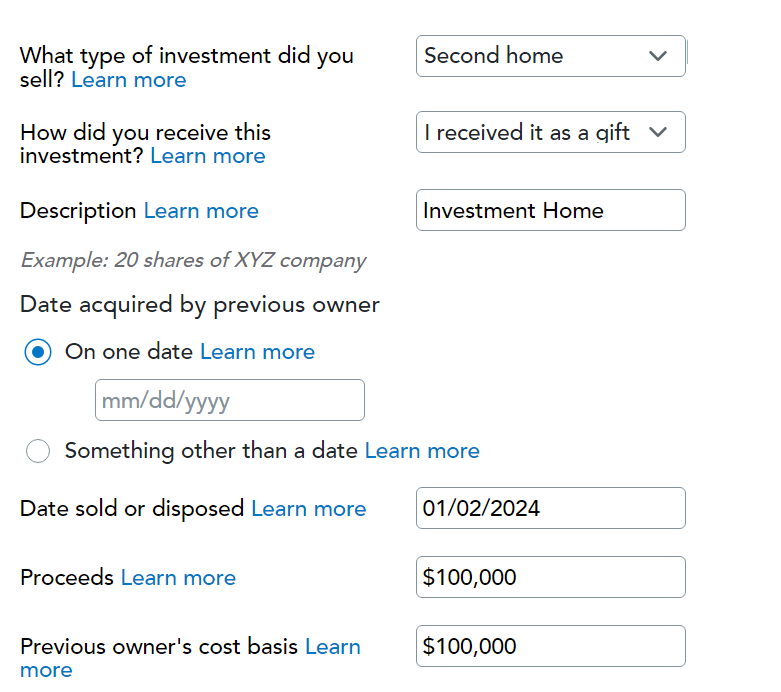

You would report it as an investment sale. You enter investment sales in the Wages and Income section of TurboTax, then Investments Sales, then Stocks, cryptocurrency, Mutual Funds, Bonds, etc... Skip the section where it asks if you want to upload your tax documents. Choose Other and Second Home as the type of investment you want to enter. You'll come to a screen where you can enter in your sales proceeds and cost basis:

The cost basis would be the cost basis your son had, which would be the fair market value of the house when his grandmother died, unless it is sold for less than that in which case it would be the fair market value when you took possession of it.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 4, 2025

1:04 PM