- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You are reporting IRS form 1099-K and reporting personal sales.

Instead of box 1a being $1,000, presume that box 1a is $1,200 with $1,000 being the sales price and $200 being the sales fees charged by Ticketmaster.

If box 1a is $1,200 and I sold some items at a loss or had no gain was $600, $600 will be reported as Proceeds on IRS form 1099-B.

$200 is reported as I paid sales expenses....

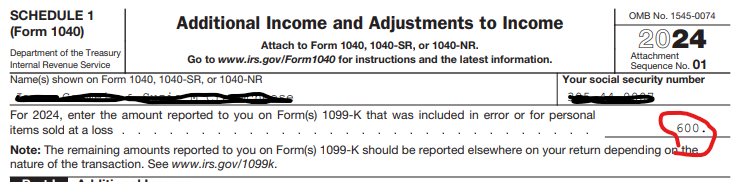

The $600 is reported at the top of Schedule 1 Additional Income and Adjustments to Income.

Here are examples.

Selling Cost

Price Basis

T1 $500 $1,000 Capital loss on personal item = $0 gain/loss

T2 $400 $300 LT Capital gain on personal item = $100 gain

T3 $0 $0 ST Capital gain on personal item = $100 gain

T4 $100 $100 No capital gain or loss = $0 gain/loss

$1,000 $1,400

Fees $200

Total $1,200

**Mark the post that answers your question by clicking on "Mark as Best Answer"