- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes. It sounds like you sold a few tickets that were personal in nature, not a business. If that is correct, you will not enter this on Schedule C, rather Schedule D.

Here's how to report this in TurboTax Online:

- Within your tax return go to the magnifying glass icon on the top right, type 1099-K and select the Jump to 1099-K link in the search results

- Choose Add a 1099-K

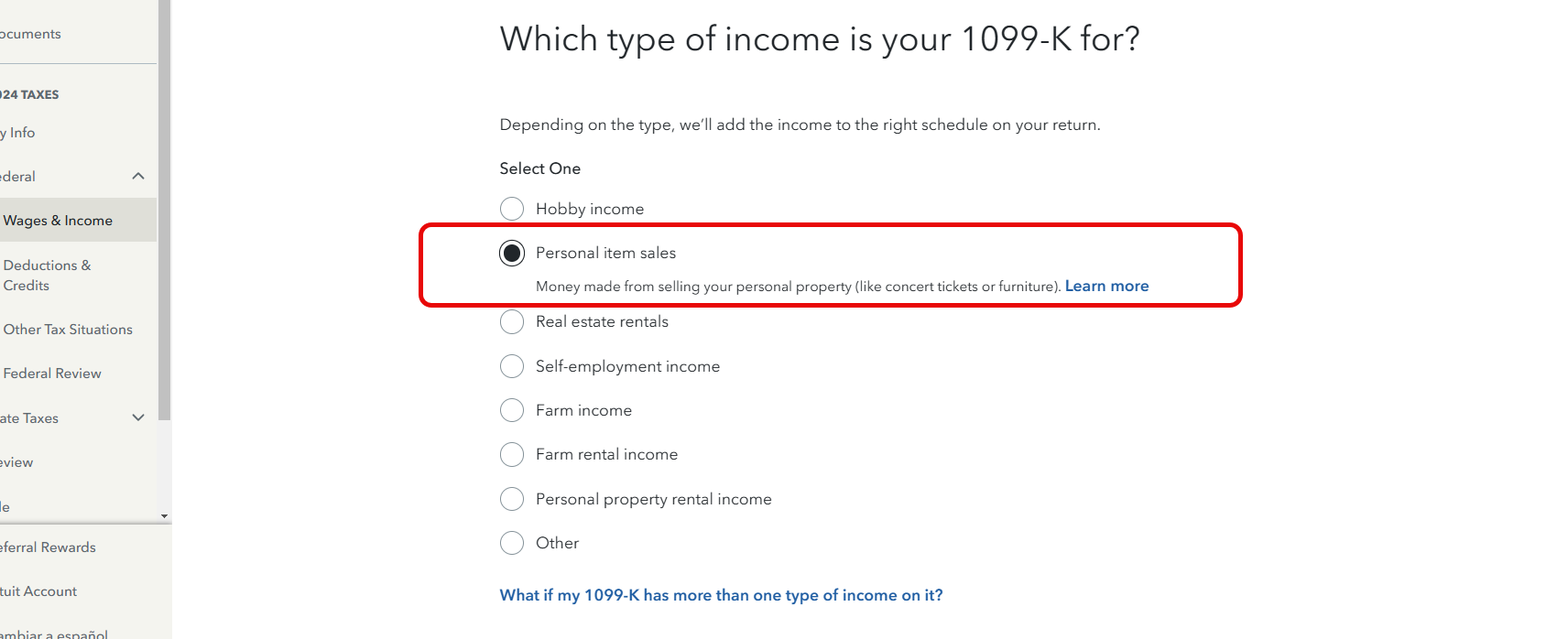

- The next screen will ask "Which type of income your 1099-K is for?" choose Personal item sales, then Continue

- Enter the information from your 1099-K, I used $5,000 as an example, report the number from your 1099-K.

- After you choose continue, the next screen will show "Personal Item Sales". If the tickets were all profitable, choose "Some items were sold at a loss or had no gain", and enter $0.

Now, TurboTax will automatically create a placeholder in investment income.

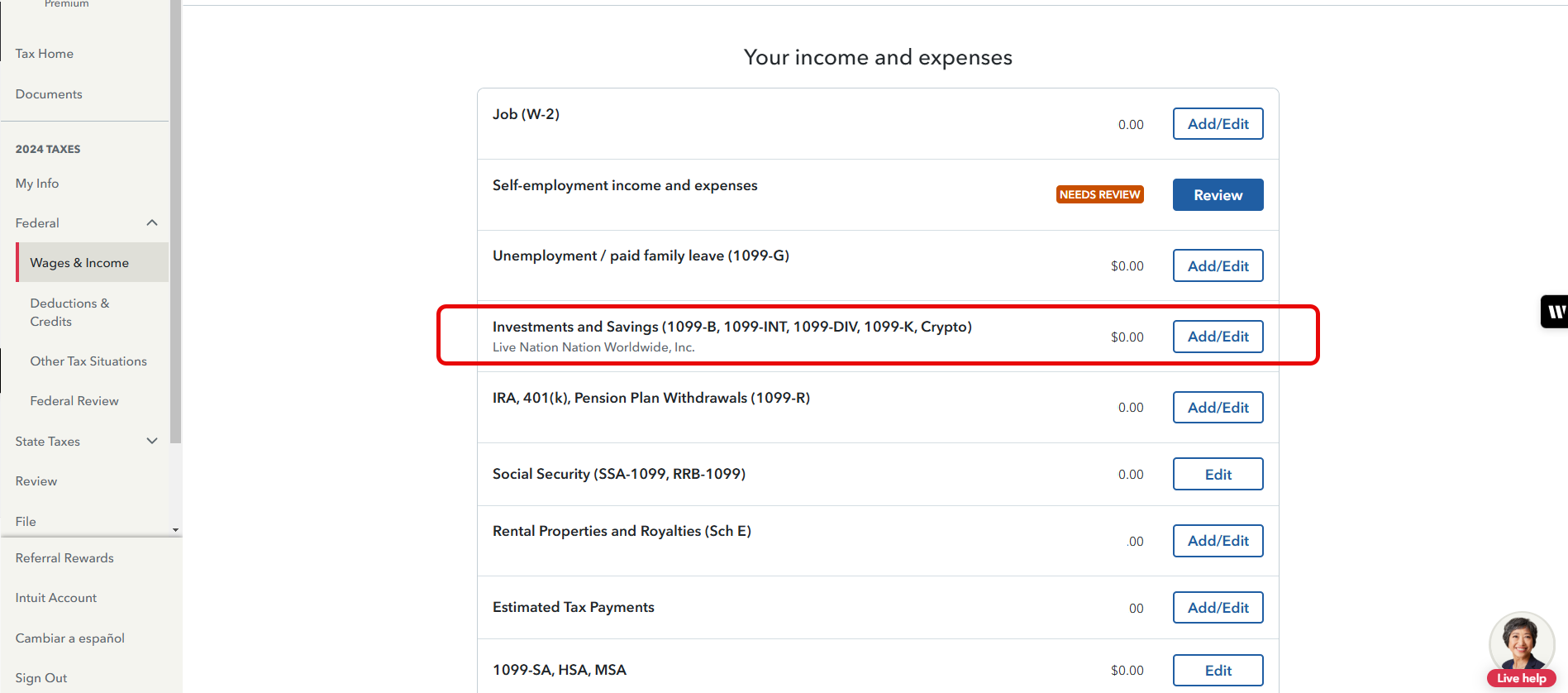

- After completing the 1099-K entry, next navigate to Federal > Wages & Income > Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto) > Add/Edit

- Select Live Nation Worldwide, Inc.

- Under proceeds, you will enter the proceeds from the 1099-K

- You will enter the total amount paid, which is your cost of the tickets

- Continue on and you will be asked if you paid "sales expenses that aren't included in the sale proceeds reported on the form", here you can report the 10% fee.

February 5, 2025

7:11 PM