- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

For a resident you can enter your Form 1042-S as follows:

Other Miscellaneous Income:

- Go to the Wages and Income section of TurboTax

- Scroll to Less Common Income > Select Miscellaneous Income, 1099-A, 1099-C

- Select Other reportable Income > Enter a description (----) and the amount

If you have any federal withholding on your form use the instructions below:

- Go to Deductions and Credits

- Scroll to Estimates and Other Taxes Paid > Select Other Income Taxes

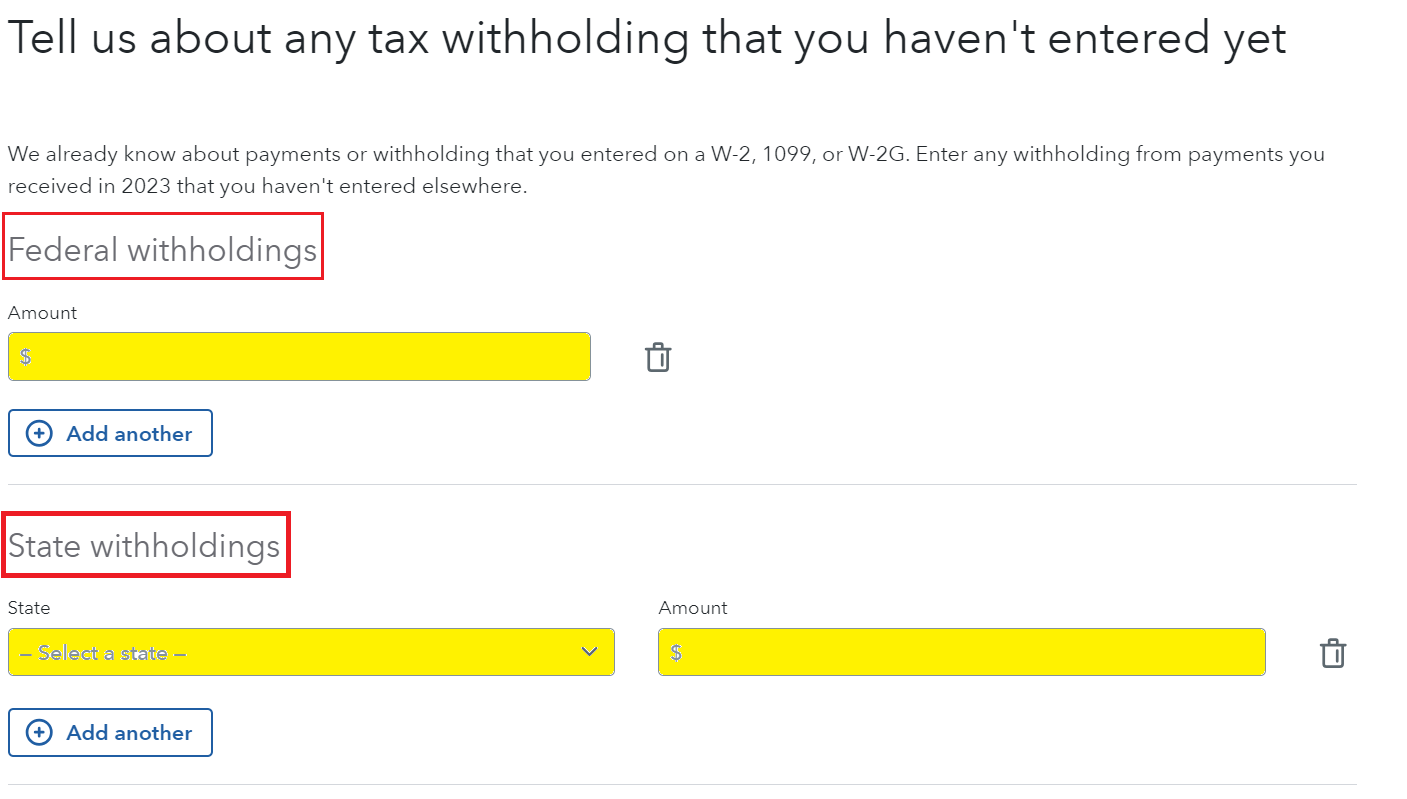

- Select Other income Taxes paid in 2023 > Withholding not already entered on a W2 or 1099.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 3, 2024

1:47 PM