- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file 1099-MISC for Chase Credit Card Referral Bonus

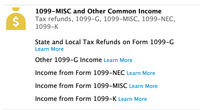

I referred my friends and family to Chase Credit card and received referral bonus. This triggered 1099-MISC being issued to me for the amount I earned as referral bonus. I am trying to report this in TurboTax in 1099-MISC section.

The 1099-MISC issues has the referral bonus amount on box 3 "Other Income". When I put this details in the TurboTax it ends up generating form for business income too and it's schedule. Then I stumbled across this post.

Which says the to put "SPIFF" and "This was a manufacturer's incentive payment" in details. Doing this does not generate business income forms and I will like to confirm this is the right way report this. Specifically that credit card referral bonus should be marked as "This was a manufacturer's incentive payment".

Also, my marginal tax rate for 2023 in TurboTax is ~22% but this 1099-MISC income gets taxed higher as it increases my federal taxes more than ~22%. Is this expected or am I doing something wrong?

Thanks.