- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to correctly file California Pregnancy SDI, PFL 1099-G and W2 in Turbotax Desktop

I am MFJ in TurboTax Desktop Software. In 2023 my spouse was on after pregnancy disability leave and then CA PFL leave.

For SDI the state paid her 60-70% of her salary and her employer covered remaining allowing her to get 100% wages. The partial payment from the employer shows up on W2 as "Parental Leave" for 2023 payslips.

1) As far as I know the 60% paid by government as pregnancy SDI is not taxable either at federal level or state level. We did not receive any form/documents for this payment from government. Is this taxable? Do I need to report this payment anywhere?

2) The partial payment paid by the company while on CA SDI shows up on W2. Is this income taxable at federal level and/or CA state level? If so how can I ensure this is being reflected correctly on my turbotax filing?

For PFL the state paid 60-70% of salary based on their calculation. There was no payment made by the company during PFL leave. So my spouse only received partial salary during PFL.

As far as I know the PFL payments are taxable at federal level but not taxable at CA state level. We revived 1099-G from state for PFL payments. I am confused about how to correctly report this in TurboTax with W2.

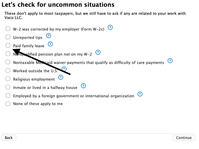

3) When I am entering my spouse W2 in TurboTax which did not had any PFL payments (but did had parental leave payments see, above) should I check the box in "Uncommon situation where it asks for "PFL"?

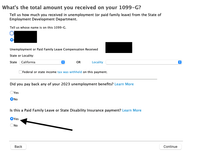

4) Is below the correct place to report 1099-G for PFL received from state?

5) In the Unemployment section under wages (4) above should I be checking the PFL field?

6) Also for some reason when I enter my spouse W2 TurboTax shows this warning to confirm W2 was entered correctly as it thinks medicare wages might be incorrect. I checked the numbers and they match what is reported on W2.