- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

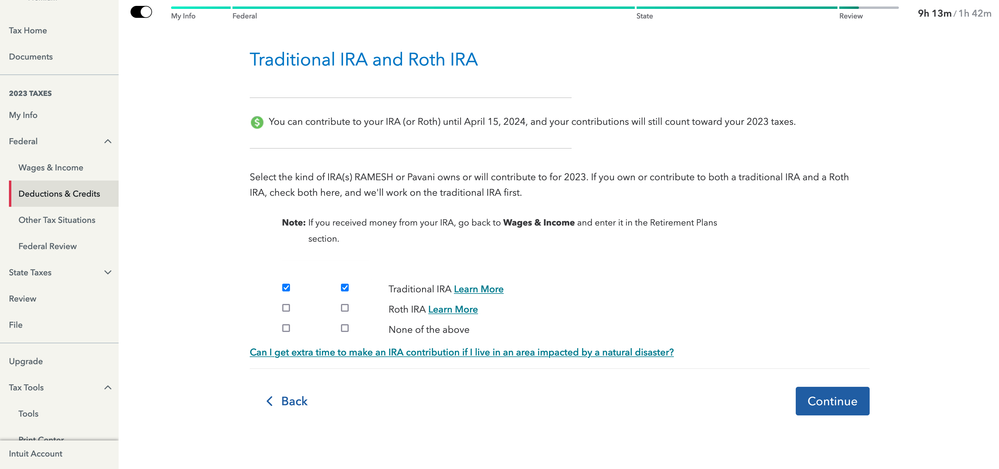

Should I select Roth IRA under Deductions & Credits for Backdoor Roth IRA situation?

- I contributed $6,500 to Traditional IRA for tax year 2023 between 1/1/2023 and 12/31/2023

- Converted entire amount($6,500) to Roth IRA for tax year 2023 between 1/1/2023 and 12/31/2023

- I did not make any direct contributions to Roth IRA

Basically, I did backdoor Roth IRA contribution because I don't qualify for regular Roth IRA contribution.

In the below screen, should I select Roth IRA or not? When I selected Roth IRA and continued, it shows I owe penalty.

April 7, 2024

8:08 PM