- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

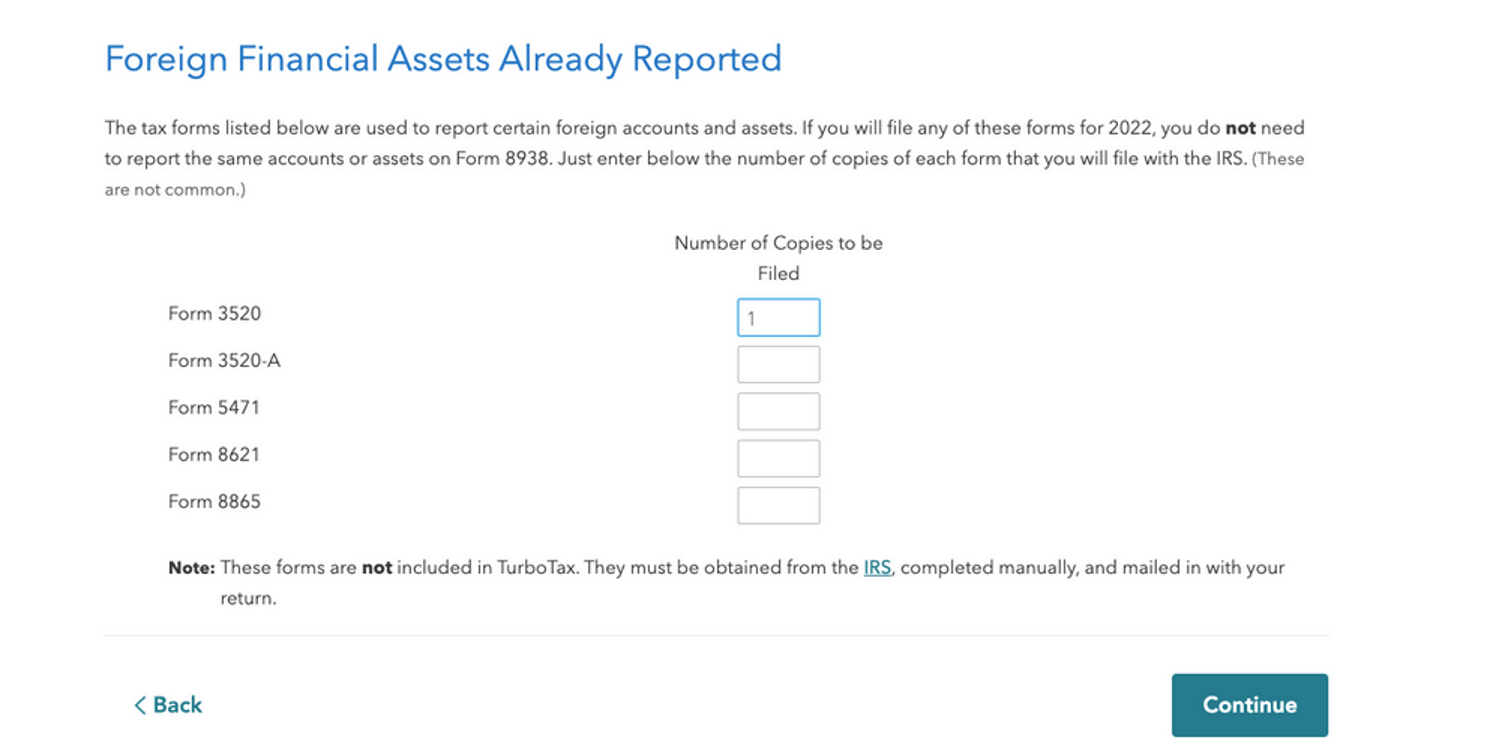

You don't find them in your return, because TurboTax does not support Forms 1040-NR, 3520, 8621, or 8865. See Forms not included with TurboTax

These forms are not included in TurboTax. They must be obtained from the completed manually, and mailed in with your return. These forms can't be e-filed.

You have entries in your return that require those forms. You can search for foreign assets and use the jump to link to return to this section.

U.S. persons (and executors of estates of U.S. decedents) file Form 3520 to report:

- Certain transactions with foreign trusts.

- Ownership of foreign trusts under the rules of sections Internal Revenue Code 671 through 679.

- Receipt of certain large gifts or bequests from certain foreign persons.

A foreign trust with at least one U.S. owner files this form annually to provide information on 3520-A about:

- the trust,

- its U.S. beneficiaries, and

- any U.S. person who is treated as an owner of any portion of the foreign trust.

A U.S. person that is a direct or indirect shareholder of a passive foreign investment company (PFIC) files Form 8621 if they:

- Receive certain direct or indirect distributions from a PFIC.

- Recognize a gain on a direct or indirect disposition of PFIC stock.

- Are reporting information with respect to a QEF or section 1296 mark-to-market election.

- Are making an election reportable in Part II of the form.

- Are required to file an annual report pursuant to section 1298(f).

A U.S. person files Form 8865 to report the information required under:

- Section 6038 (reporting with respect to controlled foreign partnerships).

- Section 6038B (reporting of transfers to foreign partnerships).

- Section 6046A (reporting of acquisitions, dispositions, and changes in foreign partnership interests).

IRS Forms - you can print all the forms above from this link and attach them with your mailed return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"