- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Assuming you are referring to an overstatement of interest income, dividend income, and proceeds from sales of investments, I'd recommend reviewing your input in the program.

There could be an extra zero or a decimal placed in the incorrect place.

- To check the input, log back into the TurboTax program and select Income & Expenses.

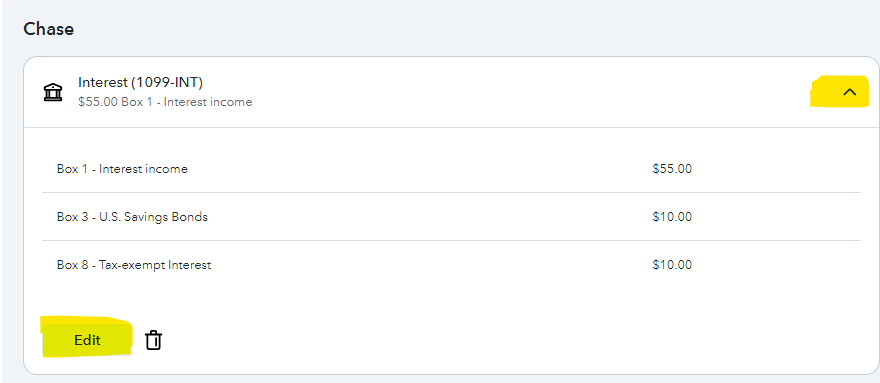

- Select edit to the right of Investment and Savings.

- For any interest or dividend income items, select the arrow to the right of the applicable input sections and select edit to review your input.

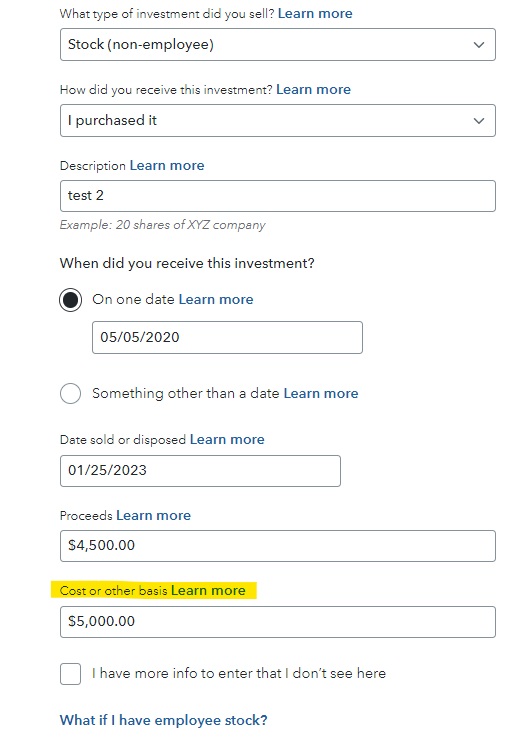

With any investment sales, make sure you have included the cost basis for each sale to ensure none of the gains are overstated. The input for any stock or property sales would be included in the same Investment and Savings input section. Be sure to review each sale and pay close attention to the box titled "Cost or other basis" to ensure you have reported the cost basis. This will ensure you are only reporting the capital gain or loss from the applicable sales.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 1, 2024

8:09 PM