- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report options subject to 1256 reporting

Hi,

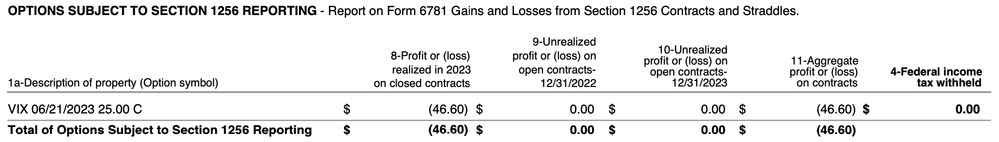

I am not sure how to report options subject to 1256 reporting. I only bought and sold one option contract (VIX), and it was sold at a loss:

When going through TurboTax online, I get asked the following questions:

1. Any Straddles or Section 1256 Contracts?

- I select "Yes" for this

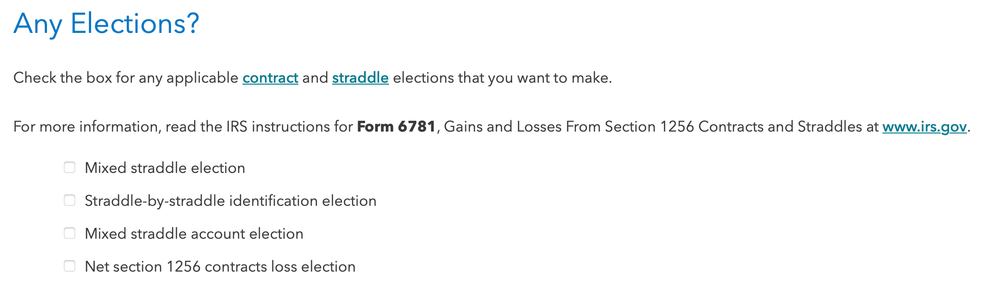

2. Any elections?

- I am not sure which option to select or should be left empty/unchecked?

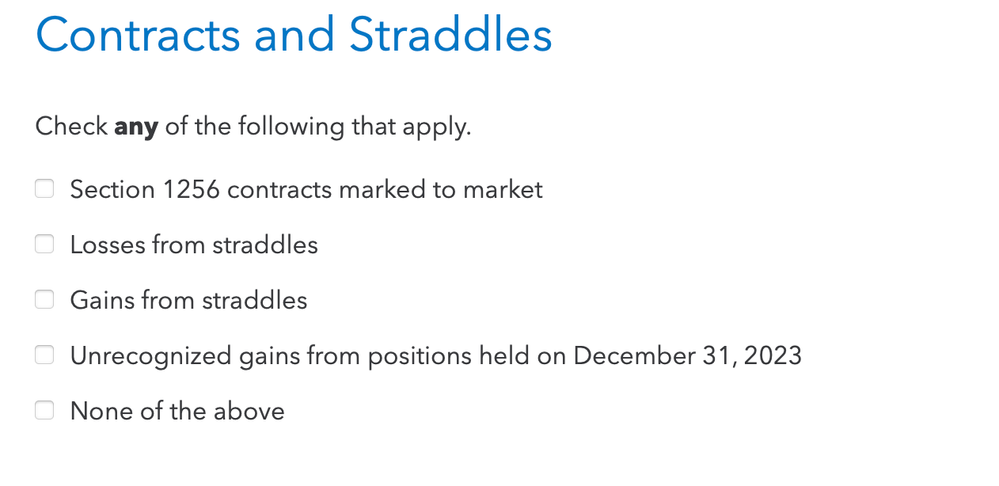

3. If left empty/unchecked, the next question is the following screenshot:

- Again, not sure which option to select but I think it should be "Section 1256 contracts marked to market" since the VIX option contract was sold at a loss?

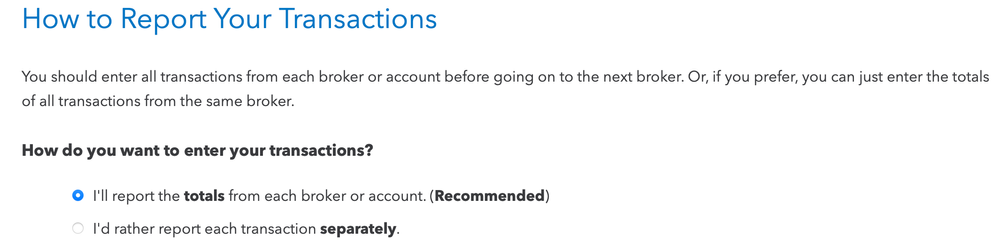

4. If I select "Section 1256 contracts marked to market", then the next question is the following screenshot:

- I only trade using one brokerage account under one broker, so for this question, I believe I would select the first option "I'll report the totals from each broker or account"

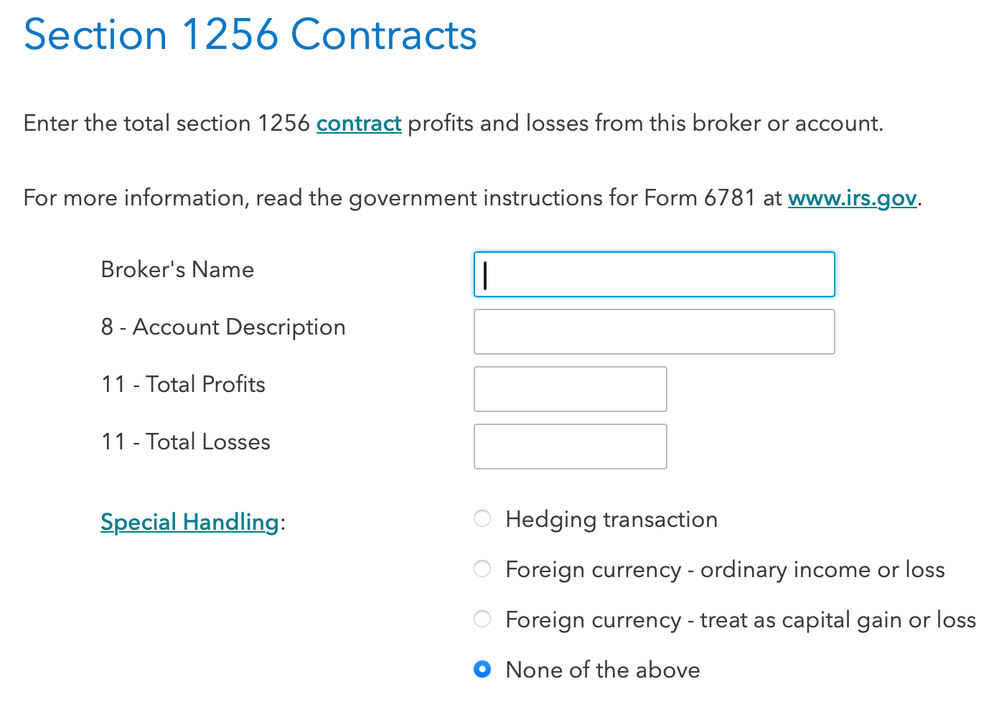

5. The next part is to enter the total section 1256 contract profits and losses for that broker or account:

- For "Broker name", I believe I would enter "Charles Schwab" (I believe this is used by TurboTax to separate different broker's when shown to the user) and for "Account Description", I believe I would enter "Charles Schwab & Co., Inc." as this is how it is shown on the "Payer's Name and Address" of the tax document generated by Schwab. I would leave "Total Profits" empty since there is no gain and put "-46.60" for "Total Losses" (looks like TurboTax does not let me put a decimal point to include ".60"? So should I round down or up?). And for "Special Handling", I believe it would be "None of the above"?

Last question, would the VIX contract also be reported on Form 8949 but that would require having information such as option contract purchase date, date sold, proceeds, and cost basis?

Thank you in advance!