- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is Unemployment received from CA classified as income? TurboTax Premier desktop version provides no guidance...

Not sure if TurboTax is becoming dummer by the Year or if they just need to hire "Americans" and stop outsourcing the program development to overseas workers with no skin in the game because they don't have to file US Taxes.

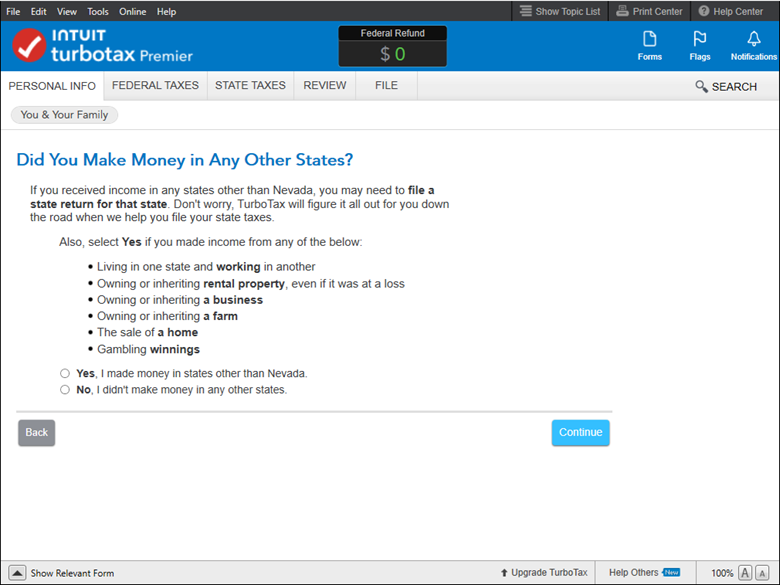

I am using the TT Desktop Premier version (after giving the online version a try for 2 years back to desktop). The question TT asks is Did you make money in any other states? So, I did receive unemployment from CA and have a 1099G; however, Unemployment is not listed on the screen as an income. Instead, the choices presented are:

My current state is Nevada which does not require state income tax filing. However, CA does, but the choices presented do not list Unemployment as "INCOME". Intuitively, I want to say YES, but will defer to the community to share their views and wisdom.

-