- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

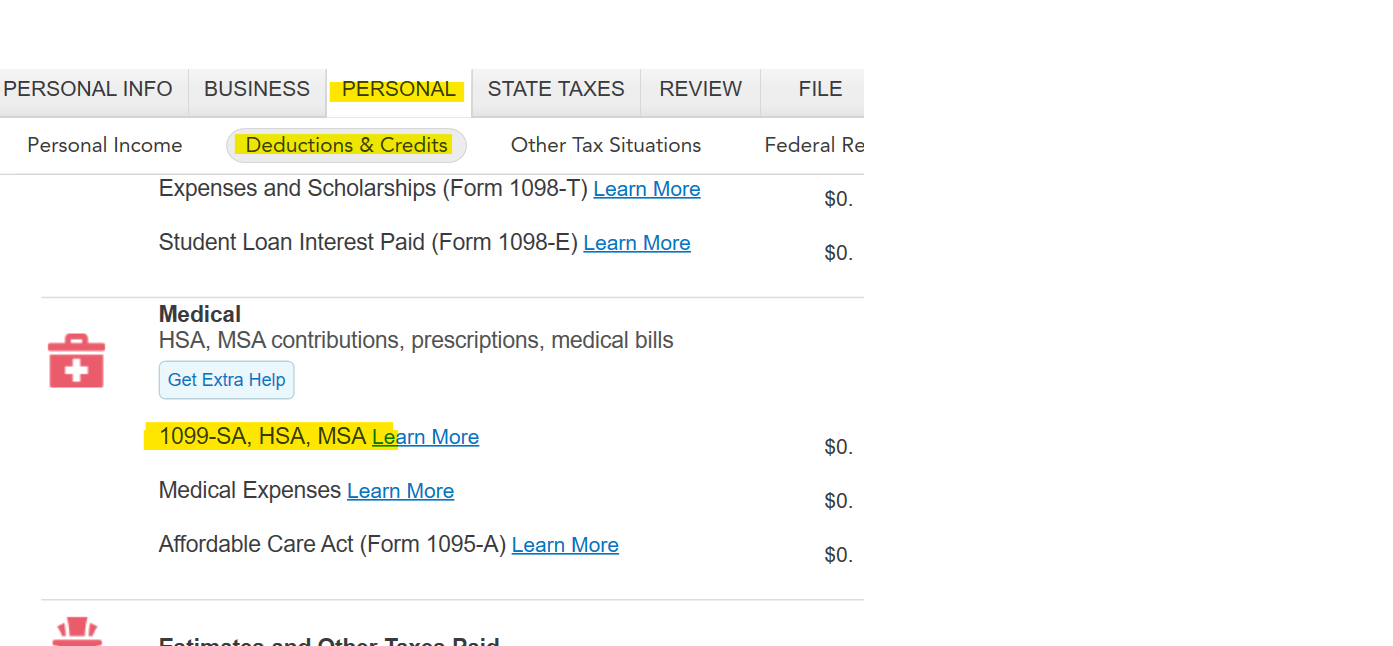

Instead of trying to fix the issue in the review section, go back to the HSA section and check your answers there - there are a couple of questions you want to double-check. You have to tell TurboTax how much of the money reported on your 1099-SA was for qualified medical expenses. To get back there in TurboTax:

- Open or continue your return in TurboTax.

- Select Search and enter 1099-SA.

- Select Jump to 1099-sa.

- Answer the questions and continue through the screens.

After you enter your 1099-SA, we'll ask Did you spend all the money you took out on medical expenses? If you answer Yes, the entire distribution in box 1 of your 1099-SA is nontaxable. However, if you answer No, the portion that wasn't used for qualified medical expenses becomes taxable income.

Go all the way through the HSA questions and if you are still having an issue, let us know what the error or reject message says. Is it because of an amount, an address, or a tax ID number??

**Mark the post that answers your question by clicking on "Mark as Best Answer"