- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

how to fill in UK bank interests in the turbo tax

Hey guys

This is the first time for me to fill the tax by myself in turbo tax. I have a few questions and hope some anyone can help. I have around 200 GBP interests from Bank A with 4 accounts and 0 GBP interests with bank B and UK employer pension plan, which is operated by scottish widow. I asked the online helper, but it seems that they are not quite sure about some details.

1. In terms of income, do I need to add one 1099int myself for bank A with interests 200 GBP (no need to mention 4 accounts separatedly)? In terms of GBPUSD currency, can I use 2023 average currency to calculate it as USD? In terms of source, can I just copy and paste the web link in it?

2. In terms of income, I assume I do not need to add bank B because no income?

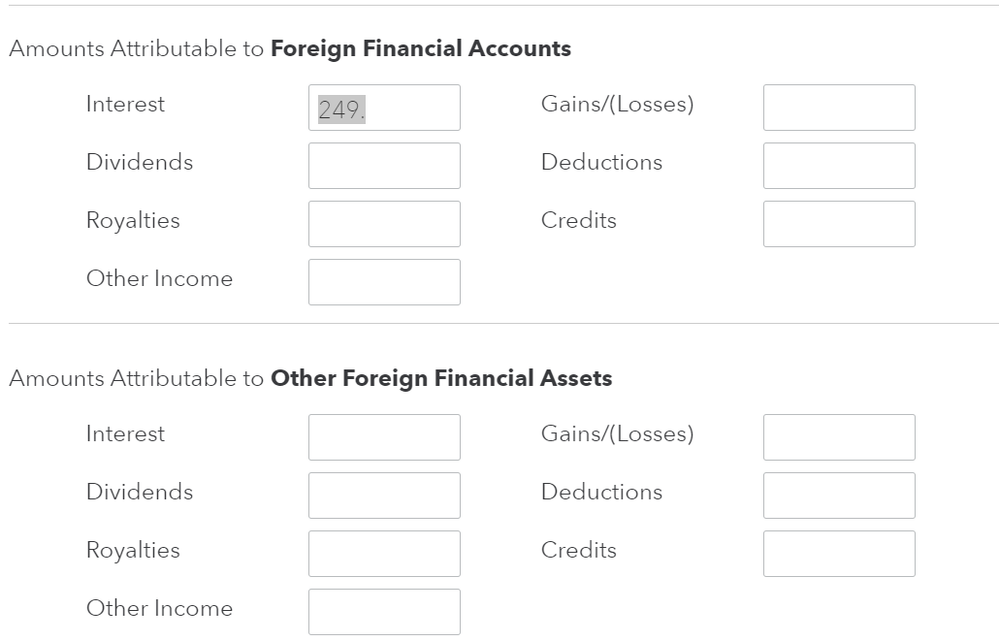

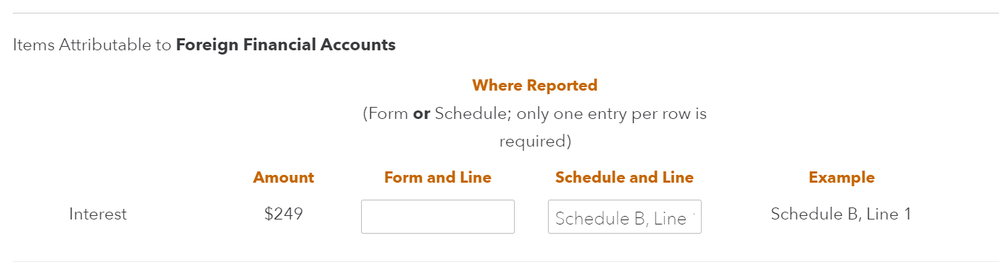

3. In terms of foreign asset, it asks me to fill in amount attributable to foreign financial account. I assume I fill in 200 GBP again here? (so in total fill in it twice). They asked me where reported and give me one example Schedule B, Line 1. should I fill in shcedule b, line 1 in the schedule and line? I filled in 1099 int in Q1, but I do not know line it is. So, I do feel confuse for it. I attached the pic here. Please let me know whether they are correct

4. In temrs of UK bank address, can I fill in the opening branch address or need headquarter?

5. If the spouse doesnt have SSN, do I have to send the pension by mail and e-file solution?

Sorry for lots of technical questions

J