- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

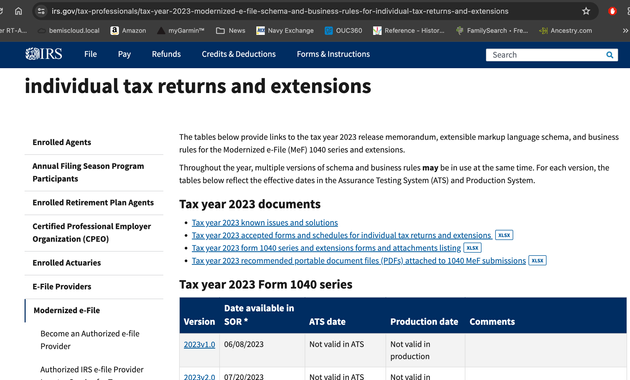

One additional thing for everyone's consideration....there is a POSSIBILITY that left hand/right hand aren't attached to the same body as well. If you research the IRS.GOV site deep enough you can find the following;

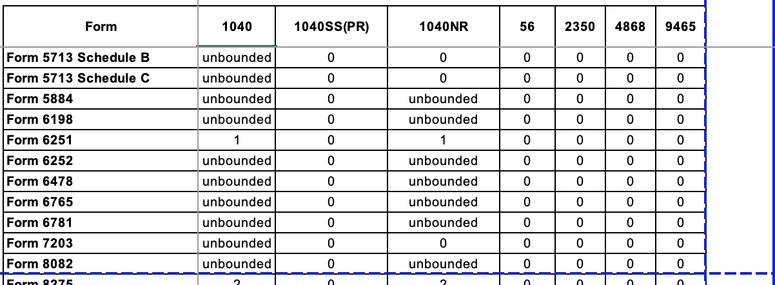

IF you download that "Tax Year 2023 accepted forms and schedules..." you might notice that Form 7206 is NOT listed, it goes from 7203 to 8082....;

SADLY however, the link of "known issues and solutions" does NOT contain anything about 7206 either.....

SO.... NOT TO CONFUSE the situation BUT..... as I had previously posted there are situations where the SE Health Insurance Premium credit can be entered WITHOUT the need for Form 7206, and certain situations where that form IS required. What I can't understand is why the IRS site appears to not address the form as being "acceptable" and fear that MIGHT be part of the problem.

REGARDLESS of everything I have offered, it is Intuit/TurboTax that are the experts and providers so most definitely THEY need to be much more proactive in getting information to their customer base about what they are (or aren't) doing about this issue that is causing so many people problems with eFile!!