- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Work days outside of New York

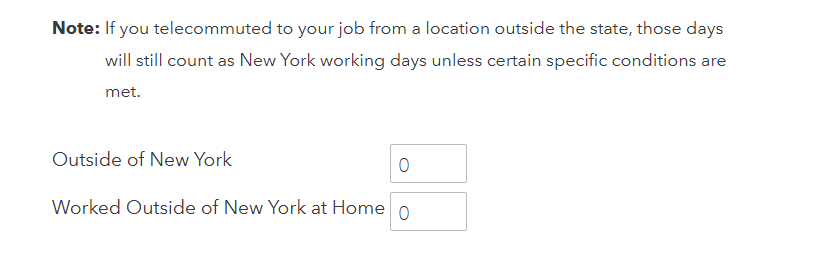

Hello, I've been reading many discussion posts and answers about working in NY as a non-resident. I get that your NY income is subject to tax if you work remotely by choice/convenience and not because it's a necessity. The part I'm a bit stuck on is putting a number in the box for days worked "Outside of New York" and "Worked Outside of New York at Home". My thought was to put 0 for both since any days that I worked at home in New Jersey, it was for my convenience and therefore those are still considered NY work days. Am I thinking of this wrong? I worked from home for 183 days out of 209 days. Should 183 go in the box for "Outside of New York"?

For more details: I elected to allocate wages to NY by number of days, my period of employment is 209, there have been 60 weekend days, 4 holidays, and 7 other nonworking days. Now I'm at this Work Days Outside of New York screen.