- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

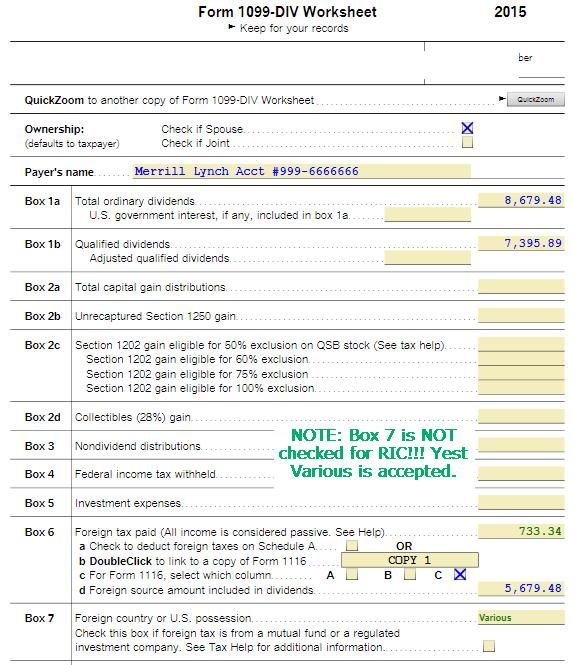

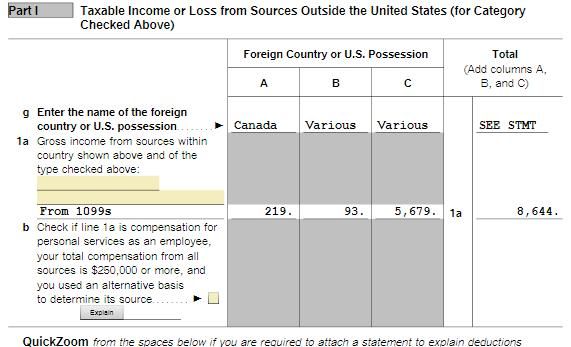

The Form 1099-DIV must report the amount of Foreign Taxes paid (or accrued) in Box 7. However, the reporting requirement does not extend to the additional needed information and is not transmitted to the IRS. That said, almost all financial service entities provide "Supplemental Tax Information" pages which would show the countries where tax was paid and the amount in that country. The other piece of information needed is the total amount of dividend income that was received from Foreign sources. This may have to be manually calculated from the detail listing of dividends paid, although some financial service entities do provide this automatically. One other point: If the dividend income is from investments in pooled funds such as mutual funds or ETFs, then there is no need to identify the country but only enter RIC" for Registered Investment Company. In the image provided, which was from prior to a regulation change, one could use the word "Various" and that still seems acceptable within TurboTax.

Since this new Community forum lacks the functionality that was present in prior forums where we could see what tax reporting product you are using, I'll simply say that the Form generated from the activity of reporting foreign tax is Form 1116. Depending on what product you are using, you may be able to directly address that form.

NOT INTUIT EMPLOYEE

USAR 64-67 AIS/ASA MOS 9301 - O3

- Just donating my time

**Say Thanks by clicking the thumb icon in the lower left corner -it means nothing but makes those than answer feel wanted.