- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Do not enter a 1099 form in TurboTax instead follow the steps later to add your retention bonus. The employer should have included the retention bonus in your W-2, but since they didn't, enter it as additional wages that were not reported on a W-2, which is what it is.

You will have to pay the Social Security and Medicare taxes that the employer should have withheld from the bonus. This will be the same amount that would have been withheld if your employer had handled it correctly and included the bonus in your W-2.

The payments will be included in the total wages on Form 1040 line 1. On the dotted line to the left of the amount on line 1 there will be a notation "F8919" and the amount. Form 8919 will be included in your return, with reason code H in column (c). Form 8919 will calculate the Social Security and Medicare taxes. The total of these taxes will appear on Schedule 2 line 6 and will be included in your total tax liability.

Follow these steps to enter the bonus. The first few steps might vary a bit in TurboTax Online, depending on what you have already done.

- Search (upper right) > type 8919 > Click the Jump to... Link >

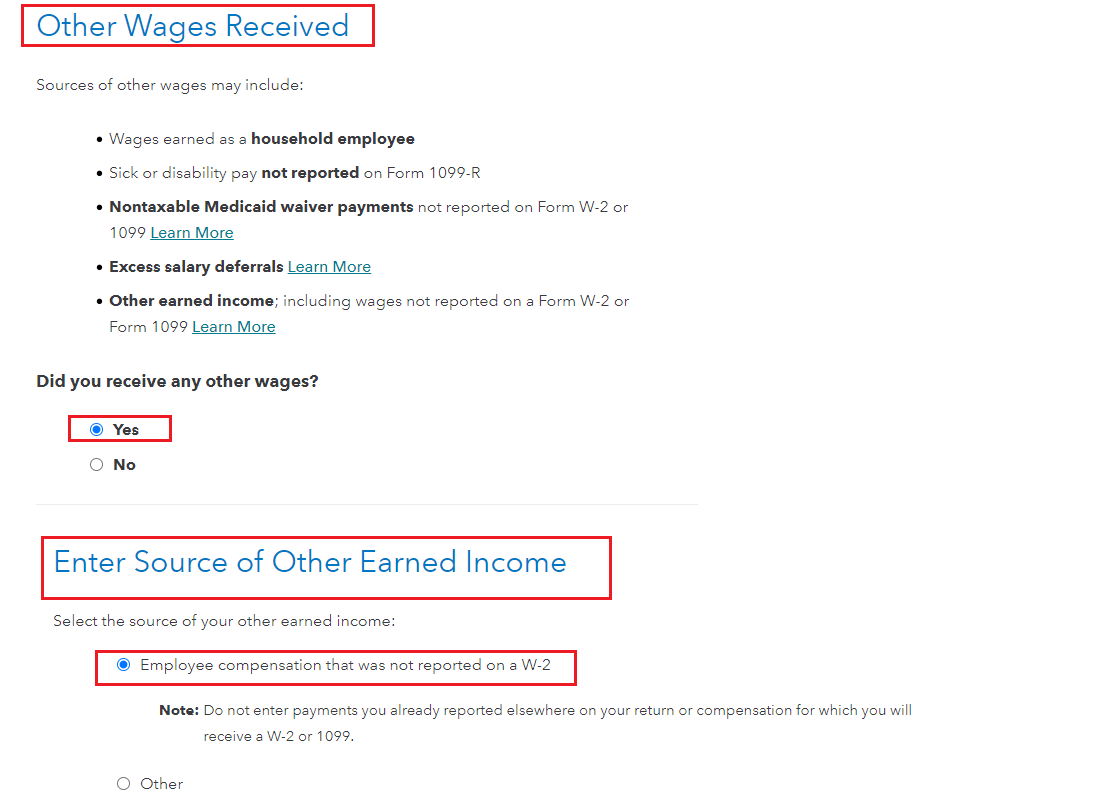

- Click 'Yes' on Other Wages Received screen > Continue to screen 'Any Other Earned Income' and click 'Yes'.

- Select 'Employee compensation that was not reported on a W-2 > Continue

- The next screen explains about Form 8919 > Continue > Select the owner of the income (if filing a joint return)

- Complete the rest of the requested employer information - Select Reason Code H > Continue > Done

- See the image below for assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"