- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

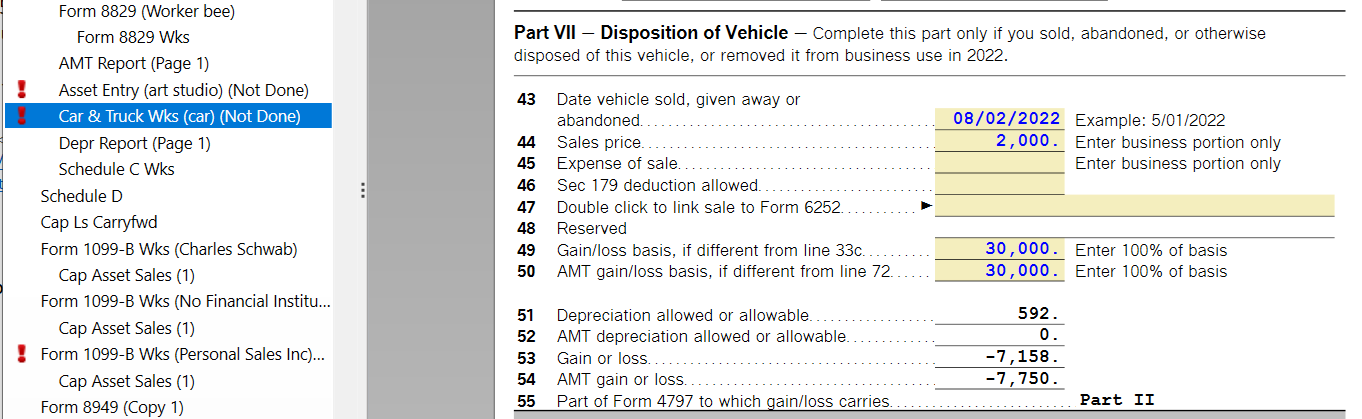

Report in the vehicle section. You will mark that you disposed of the vehicle. Select sold - you basically sold the vehicle to the insurance company - for the amount they paid.

Your basis was the value when placed in service of the business.

The program will ask about prior depreciation. If you used:

- Actual depreciation - gather the amounts from your Form 4562 and worksheet.

- Standard Mileage -The annual depreciation amount per year, per mile is included in the per IRS Publication 463 (Page 23) Car Expenses:

- 2020 - $0.27

- 2021 - $0.26

- 2022 - $0.26

The program will calculate the loss for the business portion and report the loss on your return.

Personal items sold at a loss are not reportable so the personal portion of your vehicle will not be reported on your return.

You will want to view all forms before filing since the heart of this is on the car & truck wks.

To see your forms:

- In desktop, switch to Forms Mode.

- For online, see How do I preview my TurboTax Online return before filing?

Example only as I don't know all of your information.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 13, 2023

8:52 AM