- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I get Accrued Market Discount on Treasury Notes to Populate to Schedule B as interest?

I am presently stuck and unable to complete and file my taxes. Help would be very welcome!!

I have several T Notes that have an Accrued Market Discount, and I am having difficulty getting them to populate as interest on Schedule B.

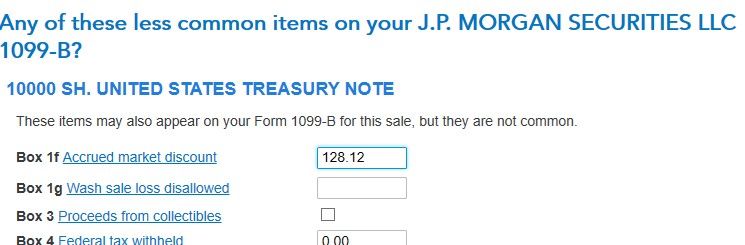

I am entering the Accrued Market Discount in step-by-step, on the screen as shown below:

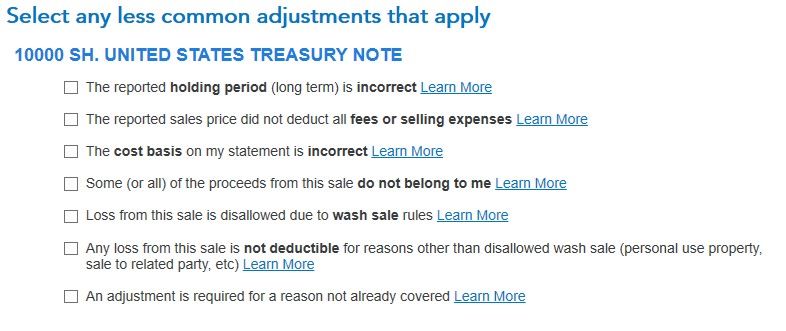

On the next screen, I do not check any boxes, as shown below:

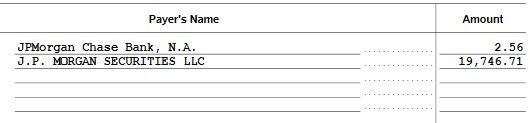

After making this entry, I see the following on Schedule B. The Accrued Market Discount is not populated as interest.

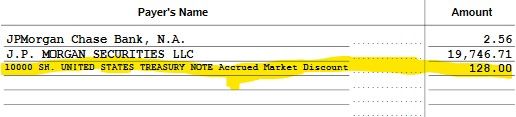

After searching the community for possible workarounds, I found a suggestion for a solution that does produce the interest entry on Schedule B.

This work around is to check the last box on the kess ciommon adjustment page (the "reason NOT already covered "), as shown below.

Sadly, this workaround produces a downstream issue (https://ttlc.intuit.com/community/taxes/discussion/turbotax-2022-premier-behaving-badly-wrt-accrued-...) which I have also offered to the community for assistance.