- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Let's start from the beginning.

When you refinance or your lender sells your loan, you’ll get 1098s for the original and the new loan. When this happens, we need to know which is the most recent

- Sign in to TurboTax and select Pick up where you left off or Review/Edit under Deductions & Credits.

- Select Show more next to Your Home and Start or Revisit next to Mortgage Interest and Refinancing (Form 1098).

- Answer Did you pay any home loans in 2022? and Continue.

- You can either sign in to your financial institution and import your 1098 forms, or select Change how I enter my form.

- Next, you can either upload a digital copy or Type it in myself.

- Continue through and be sure to enter this 1098 exactly as it appears.

- Answer the questions, and when you get to the Let's see if this is the most recent form for this loan screen, answer No to Is 1098 you're working on now the most recent for your loan?

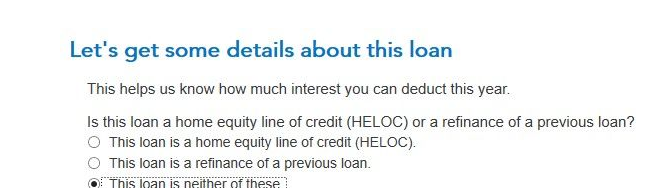

- On the next Let's get some details about this loan screen, answer "The loan is neither of these." See 2nd screenshot below:

- Have you used the money exclusivley on this home? Answer should be "YES"

- Select Continue to be taken back to the Your 1098 info so far screen.

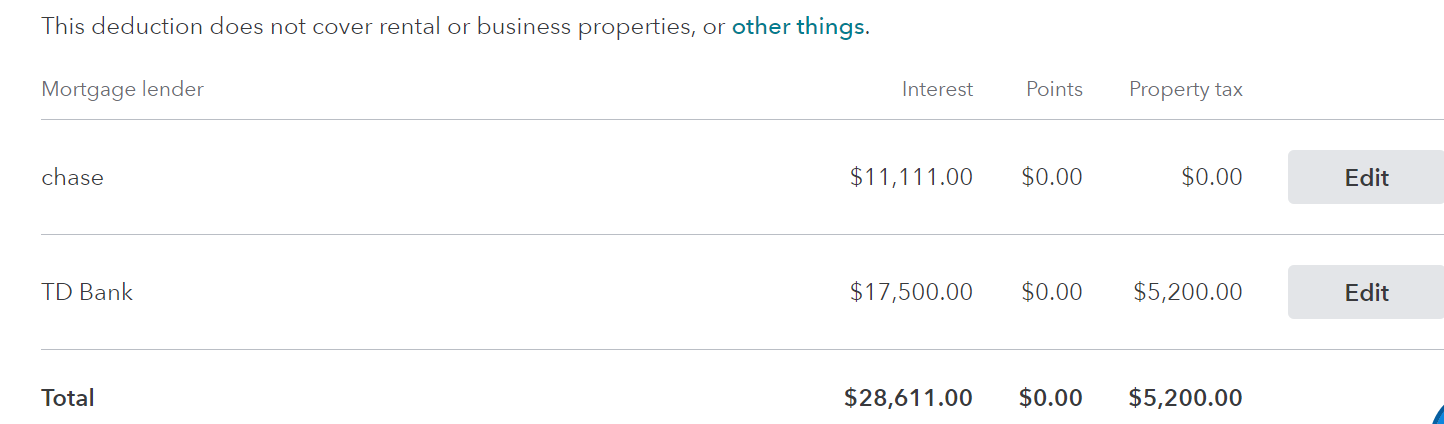

Repeat the steps for 2nd Form 1098. Once completed you will see both loans on the Mortgage Interest Worksheet. The total of both forms will be on Schedule A.

Screenshot 2 below:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 13, 2023

1:38 PM