- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

@nexchap being a frequent on this chain I bow at your will to answer all of us 🙂 I think it always benefits everyone if we look at a real life example so I'm sharing a very small full disposition of all long-term units (the easiest case) for the benefit of everyone on this forum.

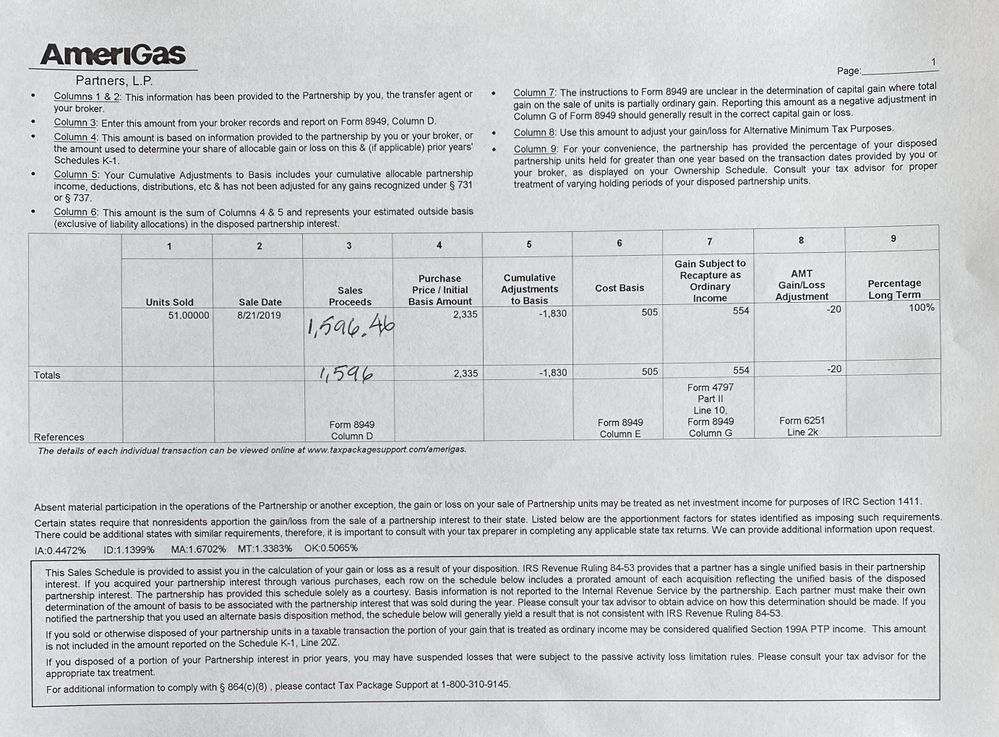

My question is not so much on the mechanics - I got those (how to file so to speak) but the overall methodology (call it a philosophical understanding). In this example I gave them $2335 some years ago, throughout that time I collected total of $554 (tax free be it as it may) and then today they gave me back $1596. Looking at the cumulative adjustments to basis my adjusted cost base is $505 so that means I am on the tax hook for 1596-505=1091. Now that 1091 is diluted with both capital gains (taxed at lower rate) and ordinary gains (taxed at income level) so as the form directs (column 7) back out 554 so we have 1091-554=537. So then I pay ordinary income on 554 and cap gain on 537. But wait, I lost money on the deal? How the heck do I owe tax on money I never saw? I bought for 2335, sold for 1596 and in the mean time collected 554 fax free, the math 1596-2335+554= (-) 185? I'm 185 in the red yet I owe both ordinary income tax and cap gain tax? I see how I owe for the recapture amount 554, sure I pocketed that but the cap gain? Gain on what, my losses? LOL