- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Your tax return does follow the correct passive activity loss rules as noted below.

- Rental losses are disallowed in full when income is above the passive activity rules for rental real estate. When income rises above $150,000 then no passive loss is allowed except to the extent of rental income. When combining the overall rental income for the current year, including the passive loss carryovers, you are being allowed a loss to the extent of the rental income received this year. Most of this can be seen on the Schedule E and Form 8582, however the amount showing as rental income is the amount of the loss being allowed on Form 4797. The allowed losses cancel out the current year income even though an excess is not allowed and will be carried forward.

As far as entering them all under one enterprise, I see the statement does not show all of the properties. My advice would be to remove the enterprise selection or mail your return with a statement included with the return similar to RREE Statement (can be viewed by using Forms mode) revising it to include all properties.

You are receiving the qualified business income deduction (QBID) on your tax return. The basics for QBID can be found in this article:

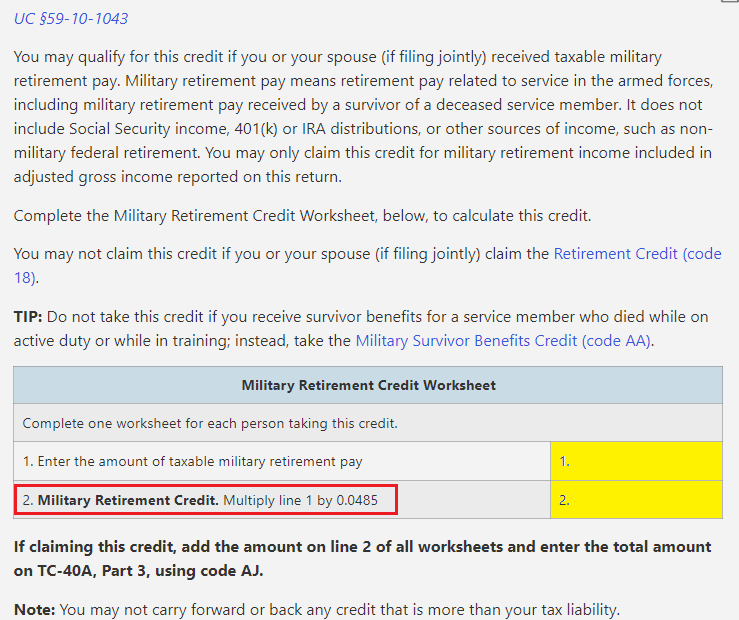

Utah is not one of the states I am familiar with however the rate of 4.85% is calculating correctly when I review the Military Retirement Credit it appears to be calculated correctly and entered in the appropriate line of the Form TC-40. See the UT Military Retirement worksheet below and you can also click the link. Compare the worksheet here with your return which is what I did.

Please update if you have more questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"