- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

If you're on Desktop and go to FORMS mode in the top right-hand corner and select Form 1040, you can see your tax return.

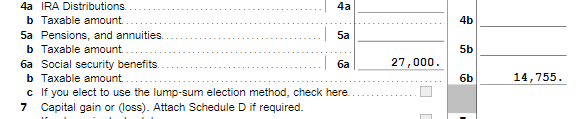

- Box 6a is your total Social Security.

- Box 6b is the taxable amount.

- If you have additional income beyond Social Security, a portion of it may be taxed.

For the 2022 tax year (which you will file in 2023), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income is more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

If this does not completely answer your question, please contact us again and provide some additional details.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 20, 2023

7:42 AM

523 Views