- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

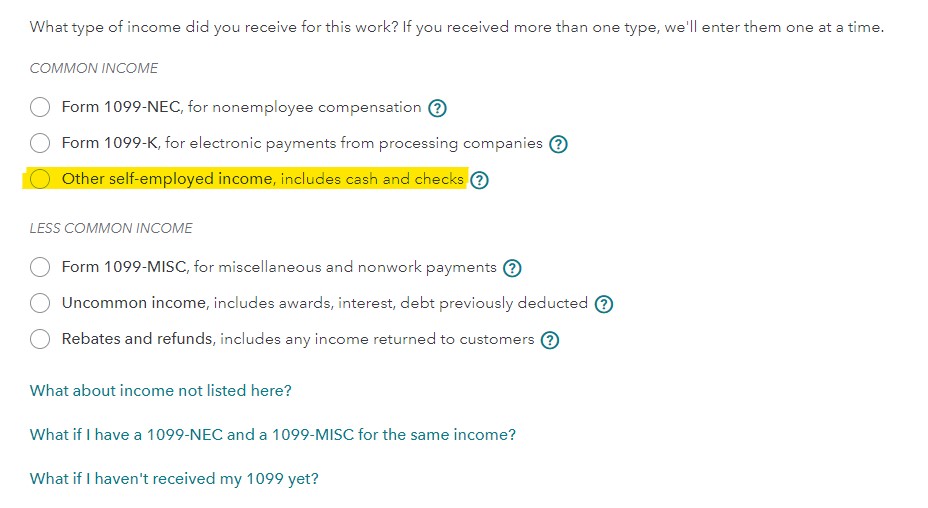

Since you are self-employed, you will report your income from doing eyebrows on Schedule C. You do not need a 1099 to report your income; there is a place to report income from cash, checks, credit cards, etc. It is common to have some or all of your self-employment income not reported on Form 1099. In the Self-employment Income section, you will see the option to choose Other self-employment income.

You will need Deluxe to report the income. And you will need the Self-Employed version if you have business-related expenses to deduct. The expenses will lower your taxable income. Click this link to see the type of business deductions you can claim on your Schedule C.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 14, 2023

12:49 PM