- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

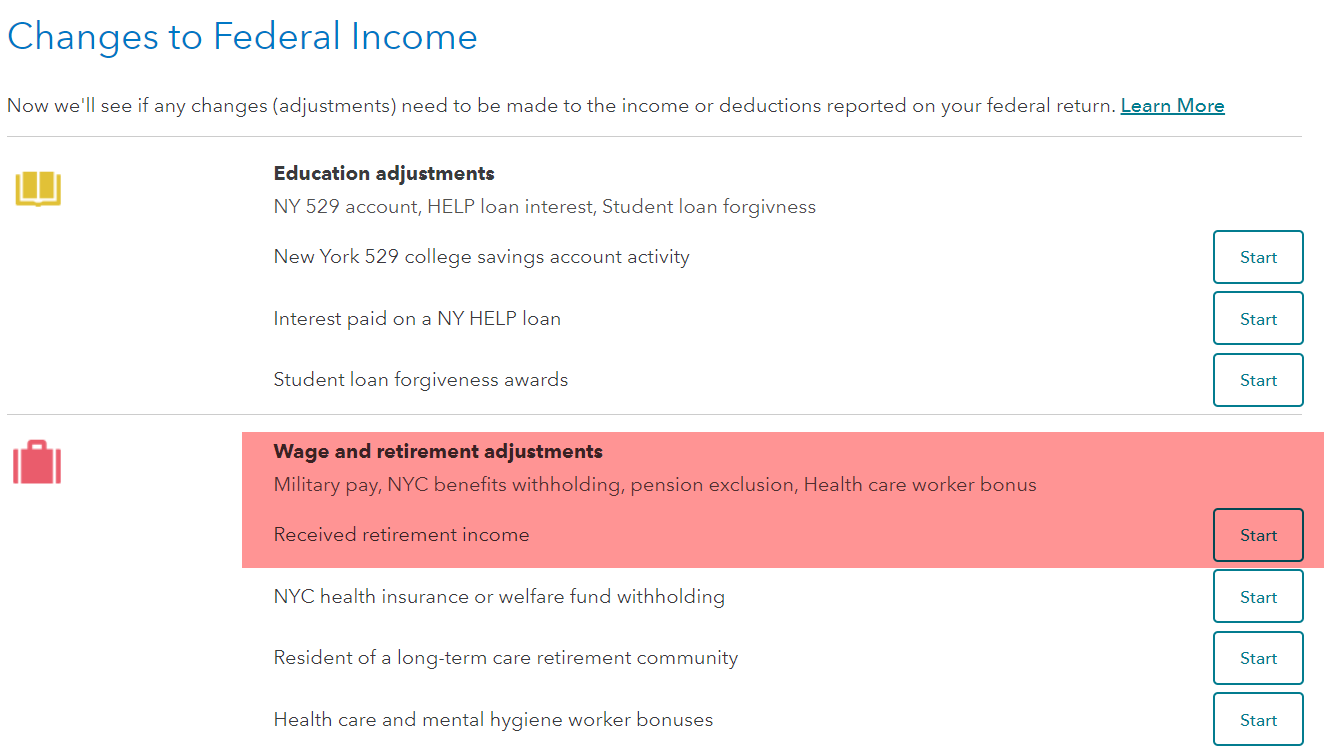

Your NYS HSB amount will be reflected in Box 1 of your W-2. Enter the information on your form W-2 as normal. The bonus received is taxable for Federal purposes but not for NYS purposes. To correctly report the bonus and get the deduction, go to your NYS return entry screens and then enter the amount under Wage and retirement adjustments. A screenshot of the entry screen to TurboTax Online shows below:

Once entered, the amount of the bonus will show as a deduction from income for NYS taxable income.

Health Care Worker Bonus Program

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 24, 2023

7:28 AM

503 Views