- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file interest earned from IRS without 1099-INT on Turbotax Business for a C-corporation?

How do I file interest earned from IRS without 1099-INT on Turbotax Business for a C-corporation?

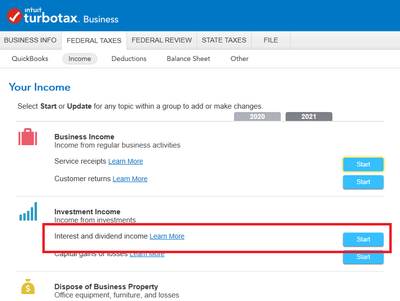

I received some interests from IRS for a tax refund, and IRS did not issue 1099-INT since it was under $10. Where do I report this income on Turbotax Business?

Topics:

September 2, 2022

8:08 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thanks, which box should I enter the interest received from IRS?

September 2, 2022

10:17 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

It goes on the first line ... the second one is for bond interest.

September 3, 2022

6:49 AM

325 Views