What's the difference between a 1099-NEC and 1099-MISC for self-employed income?

by TurboTax•1089• Updated 7 months ago

Starting in tax year 2020, the IRS reinstated Form 1099-NEC to report nonemployee compensation that used to be reported on box 7 of the 1099-MISC form.

Let’s take a look at the differences.

You'll get a 1099-NEC if you:

- Worked as a contractor or freelancer

- Were paid for your self-employed goods or services

- Previously received these payments on a 1099-MISC

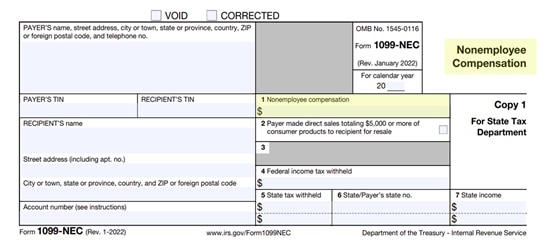

Take a look at the 1099-NEC:

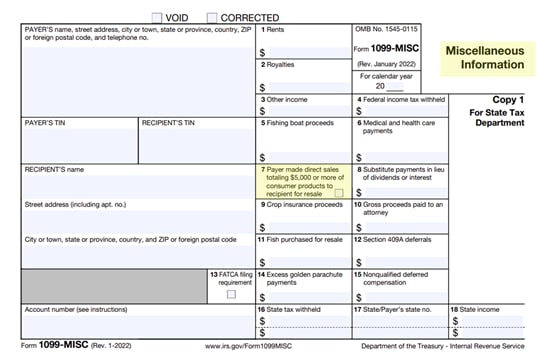

Compare it with the 1099-MISC:

Box 7 no longer reports nonemployment compensation now that the 1099-NEC form is being used. The 1099-MISC is mostly used for miscellaneous income like rent or royalties.

If you were paid for your work on a 1099-MISC, contact the payer directly and ask them to send you a 1099-NEC form instead.

Rest assured that TurboTax will guide you through entering all of your self-employment income and help you enter any expenses to reduce your taxable income.

Now that you're familiar with the differences between these two forms, see our instructions for entering your 1099-NEC or 1099-MISC in TurboTax.

More like this

- Does a 1099-NEC or 1099-MISC mean I'm self-employed?by TurboTax

- How does being self-employed affect my taxes?by TurboTax

- Why am I paying self-employment tax?by TurboTax

- Where do I enter Schedule C?by TurboTax