- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

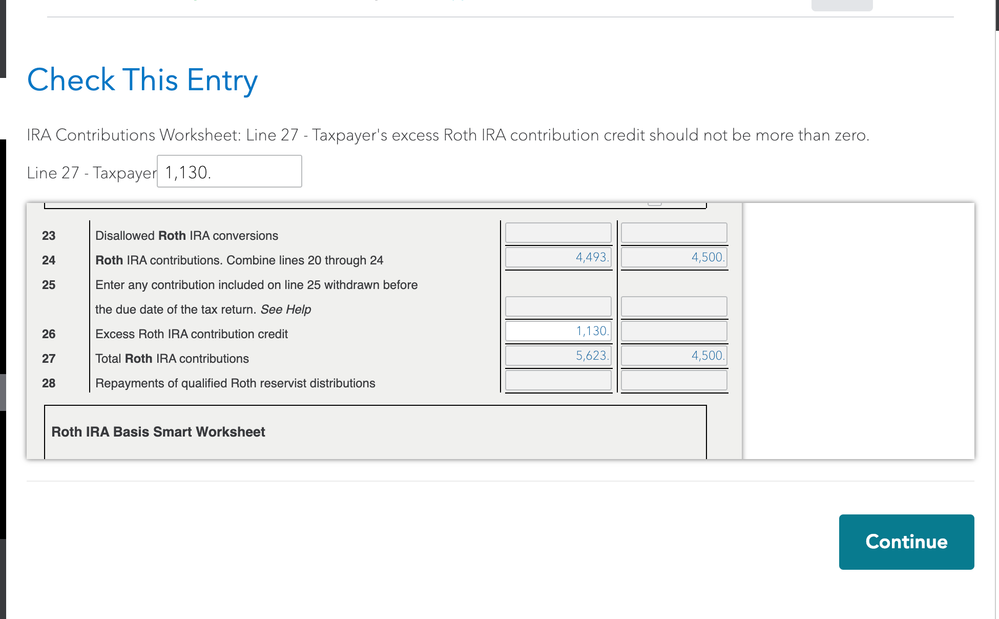

I over contributed last year to Roth. I payed fine and contributed less this year. Error: Taxpayer excess roth ira contribution credit cannot be more than zero. Solution?

I over contributed last year to Roth IRA. I payed 6% fine and contributed less this year. I am trying to carry over 1130 of excess contribution from last year. I am not able to e-file because of this error: Taxpayer excess roth ira contribution credit cannot be more than zero. What should I do?

Topics:

March 1, 2021

7:59 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

You need to enter a negative number, since the credit would reduce your overpayment. A credit is a negative amount, that is.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 1, 2021

12:55 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

So maybe I didn't filled up the form correctly and it is probably not a credit. If I overpayed by 1130 last year(I payed the 6% fine) and this year reduced my contribution so that excess is no longer carried going forward in future, should I add 1130 to the amount I contributed this year and have that in the form?

March 1, 2021

1:26 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

At some point in the recent past the TurboTax developers changed TurboTax to automatically apply as a current-year Roth IRA contribution as much of an excess Roth IRA contribution carried into the current year as possible, so the entry in question is no longer needed. Simply delete the $1,130 entry.

March 1, 2021

4:28 PM