- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Returned my RMD but TurboTax is showing it as taxable income

I got part of my RMD in 2020 before the RMD was waived. I returned the RMD but TurboTax is still showing it as taxable income. How to I correct this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

I answered that all of the RMD had been returned. After that TurboTax indicated that I would not owe any taxes. Later, under the detailed itemization, the RMD was listed as taxable. If it makes a difference, the RMD paid out in part to me and in part as a qualified charitable distribution, but I returned the whole RMD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

From Champ @macuser_22:

"For a simple return of a RMD do not say that is was a RMD because the 2020 RMD did not exist. NO 2020 distribution was a RMD.

The CARES act provisions fir the 3 year return of distributions, and the 8915-E form that reports them, has not yet be added to the TurboTax interview because as of now the new 891E for does not yet exist (it only exists in the DRAFT state at the IRS). Until the IRS finishes and publishes the final form and releases the electronic file specifications for that form, TurboTax (and users) can only wait. As of now, there is not even any estimated release date.

You can view the draft form here:

https://www.irs.gov/pub/irs-dft/f8915e--dft.pdf

https://www.irs.gov/pub/irs-dft/i8915e--dft.pdf

Subject to change of course since it is a draft.

You can view the draft form here:

https://www.irs.gov/pub/irs-dft/f8915e--dft.pdf

https://www.irs.gov/pub/irs-dft/i8915e--dft.pdf

Subject to change of course since it is a draft."

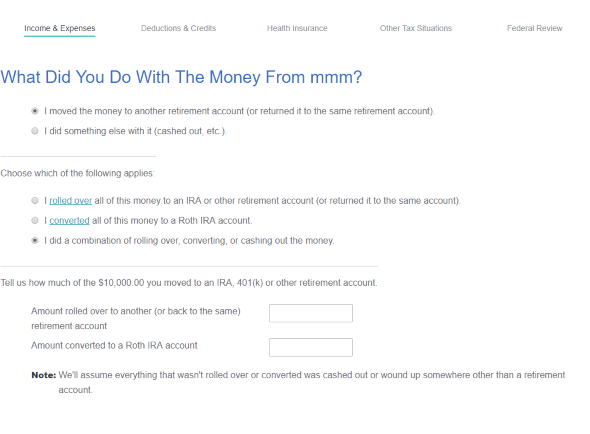

Type '1099r' in the Search area, then click on 'Jump to 1099r' to Edit your 1099-R entry.

You may need to Delete/Re-enter your 1099-R if this does not resolve your issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"