- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

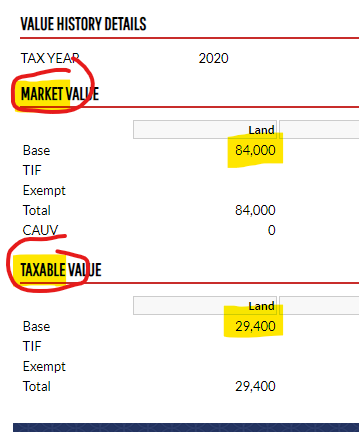

Depreciation Basis - Land Value "Market" vs. "Taxable" Value ?

What should be used for a rental property depreciation calculation for Land value?

"Market" vs. "Taxable" ?

Topics:

May 5, 2021

5:11 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

none of the above. Land is rarely depreciable. the only situation I've ever come across where it was was when it was used as a waste dump by a private company. after so much no more use.

as for splitting the cost of real property between land and buildings, it's supposed to be based on their relative values. however, many tax bills do not reflect their true value. ask a realtor in your area.

May 5, 2021

5:22 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Thanks for the response. Yes, I am aware of that. I'm asking in the context of subtracting the value of the land from the purchase price of the property.

May 5, 2021

5:49 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@Mike9241 - can you help based on my clarification? Thanks

May 5, 2021

6:33 PM