- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business sale

I sold my business in 2018, my CPA submitted all the necessary forms. I decided to do my taxes this year on Turbo Tax myself. I'm looking for information on how to show income within TT, for the 50% balance due in 2019. In 2018, 50% of business was paid, remaining paid mid year in 2019. Any help, suggestions, sincerely appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

@jahad70 wrote:

...I'm looking for information on how to show income within TT, for the 50% balance due in 2019.

Did your CPA report the sale as an installment sale on Form 6252 in 2018? If so, you should enter the transaction as such for 2019.

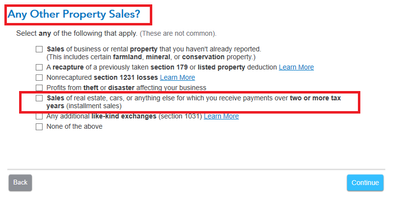

In the Search box, enter "installment sales", click the magnifying glass icon, and then click the "Jump to installment sales" link. Check the box on the screen as shown in the screenshot below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

it depends on how your accountant reported the sale in 2018. he may have reported the entire sale and picked up the entire gain in that year or he could have used the installment method. there would be form 6252 in the 2018 return. if the full gain was reported in 2018 that would leave only the interest income to pick up in 2019. if the installment method (6252) then you would need to enter the principal collected in 2019 and also report the interest income