- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I handle fully depreciated equipment with 1120S final return?

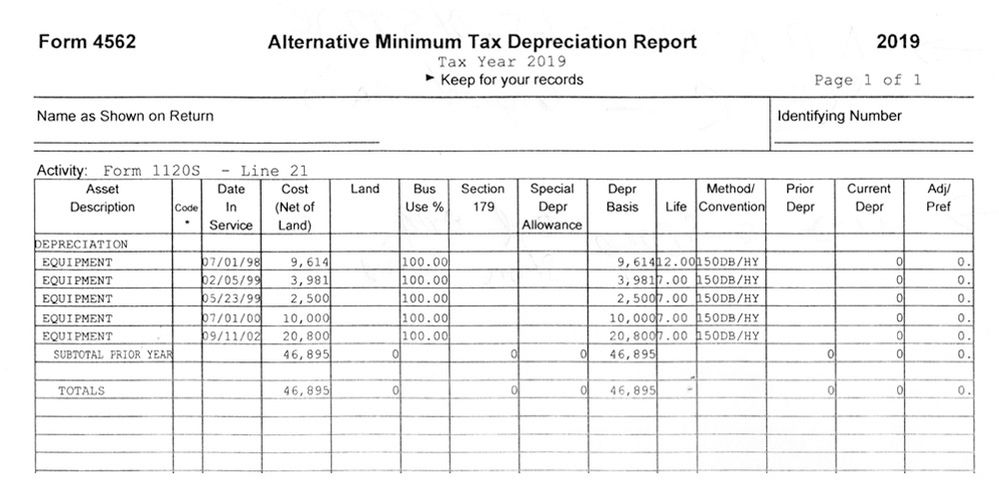

Do I need to report form 4562 as shown here with the 1120S final return and if so; how? Is section-179-recapture affecting me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

you gave us the AMT 4562, not the regular 4564 depreciation report. anyway, there would be no 179 recapture because they have reached the end of their depreciable life. the info you did not supply. do these assets have any value and what are you going to do with them. if no value to get rid of them show them sold for $0.

to summarize what the tax laws say is that distribution of assets to a stockholder in complete liquidation are deemed sold to him at Fair Market Value. the "sale" is reported on the S Corp return.

the gain realized increases the shareholder's tax basis in the Corp while the bais is reduced for the FMV of the distributed assets, other assets distributed that have the same tax basis and FMV like cash further reduce tax basis in the corp. if there's tax basis remaining you have a capital loss, if tax basis goes negative you have a capital gain.

in most situations, if the Corp was always an S-Corp and the proper accounting was done along the way you should end up with zero tax basis.

In general, pursuant to I.R.C. §336, gain or loss is recognized to a liquidating corporation upon the distribution of property in complete liquidation as if the property were being sold to the distributee at its fair market value. If the shareholder’s stock basis is large enough, the corporation can liquidate and incur no tax liability because the shareholder’s stock basis will not be depleted, only reduced, in the liquidating distributions.

After all assets have been distributed, if the shareholder’s stock basis is more than $0, there will be a capital loss in the amount by which the stock basis exceeds $0, and that loss can be used to offset any capital gains incurred in other distributions. However, if the stock basis is depleted before the corporation distributes all of its assets, then any subsequent distributions will result in taxable gain to the extent there is gain recognized in those subsequent distributions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Thank you Mike for your response.

The equipment was taken to a recycle place for recycling when I ended the warehouse's lease last year. These assets have no any value at all.

Could you please elaborate a little bit how to report this on the S Corp return?

The shareholder's basis is $27,900. Is all that amount to be distributed to shareholders, which in my case, it's only me?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

The liquidation of a partner’s entire partnership interest can take various forms, including payment made by the partnership to the retiring partner in complete redemption of the partner’s interest or a sale of such interest to the remaining partners. In both circumstances, the retiring partner receives cash or property in exchange for his partnership interest and the remaining partners proportionately increase their share in the assets of the partnership. In your case, since it is only you, the entire "interest in the assets of the partnership" ($27,900) gets distributed to the partner(s) (you) and it is as simple as that. The K1 generated for you will show the calculation of the disillusion of the partnership and the remaining will be "taxable" to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Thank you Wendy!

Everything is clear now for me except "remaining will be "taxable" to you".

What part of the assets will exceed what?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

it depends. It looks like you have fully depreciated assets and none of the assets in the screenshot you sent appears to be taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"