- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter "Investment Credit - Alabama Jobs Act" information that would go in "Part P" of 2023 Alabama Schedule OC?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

TurboTax does have an entry spot for that specific credit. Page through the Alabama state credits until you come to the screen titled Let's Check for More Alabama Credits. The next to last line item is for the AL Investment Credit. If you click Start or Update there, you can enter all the information and TurboTax will complete Part P. There is a screenshot of Schedule OC, Part P below. The amending instructions are linked here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

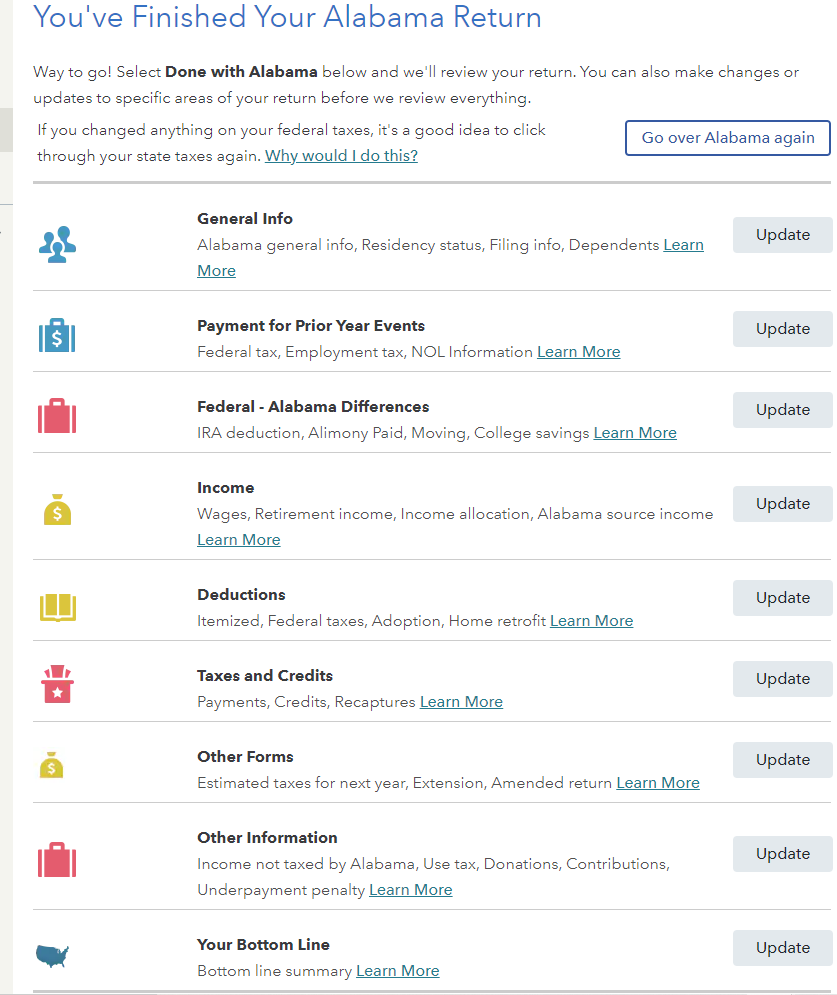

Click on Update next to Taxes and Credits from your image above, and slowly click through the screens. The order of screens you will see is:

- Credit for Tax Paid to another state

- AL Adoption

- Non-failing schools

- Donations

- Small Town Docs

- Rehab

- Neighborhood

- Dual Enrollment

- Renewal Act - Carryover

- Storm Shelter

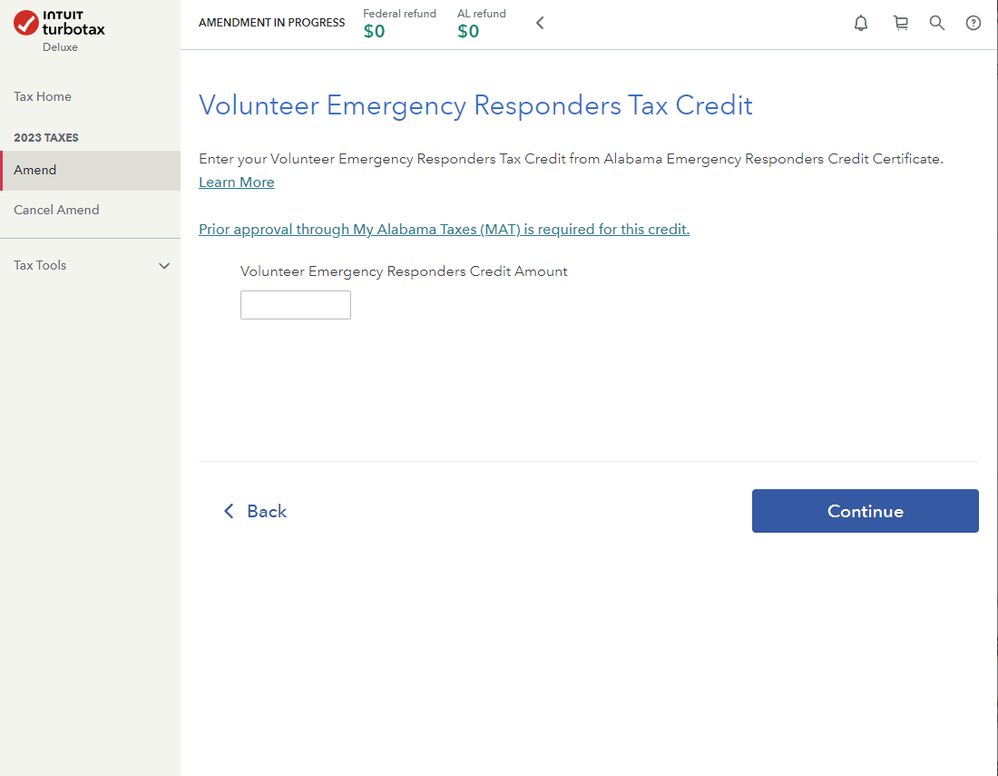

- VERT - volunteer emergency responders

- The next screen is the screen you want. Lets Check for More Alabama Credits - scroll down to the next to last line item....

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Thank you again Dawn.

I did as you suggested, and the order I see is:

- Credit for Tax Paid to another state

- AL Adoption

- Non-failing schools

- Donations

- Small Town Docs

- Rehab

- Neighborhood

- Dual Enrollment

- Renewal Act - Carryover

- Storm Shelter

- VERT - volunteer emergency responders

However, when I click "Continue" from the "VERT" page, it just takes me back to the page I started from "You've Finished Your Alabama Return". For some reason, I do not get the "Lets Check for More Alabama Credits" page after VERT. At this point, I'll probably just fill out my Amended return by hand. Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Did this ever get resolved? I am trying to fill out my 2024 return, and I received a letter from the Alabama Department of Revenue saying I have an investment credit. I have tried everything to figure out how to add this to my Alabama return on Intuit TurboTax Premium. I have spent hours chatting with your help service, and they have had me walk through every screen multiple times. Can someone please tell me how to complete a Schedule OC Part P and add this credit? I feel like it shouldn't be this hard.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

I only get the screen Let's Check for More Alabama Credits, with the Alabama Annual Investment Tax Credit listed if I have entered a business on the federal side of the program.

If you do have a business reported, I'd suggest deleting the existing Alabama return and starting a new one.

**Mark the post that answers your question by clicking on "Mark as Best Answer"