- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed and mailed my 2019 taxes in January 2021, I haven’t received my return yet. How should I answer to the question asking about my 2019 taxes situation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@ niloofar-v wrote: "I filed and mailed my 2019 taxes in January 2021, I haven’t received my return yet. How should I answer to the question asking about my 2019 taxes situation?

"the question..."

We don't know what the 2019 question is that you mention, so we have to guess a bit.

First of all, what is the context? Are you asking in regards to the 2020 return interview?

If so, are you referring to efiling and needing the 2019 AGI to verify the 2020 return when efiling? If so, since you filed the 2019 return so late, you can't use the actual 2019 AGI. Instead, you would use a 2019 AGI of 0 (zero) to verify the 2020 return when you are in the process of efiling.

Or are you referring to a question that asks if you filed a 2019 return? (which you have--assuming the IRS received it)

Or what??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Yes, that is referring to efiling. I received the receipt for my 2019 state taxes but there is no information regarding my federal taxes when I check through Check My Refund Status.

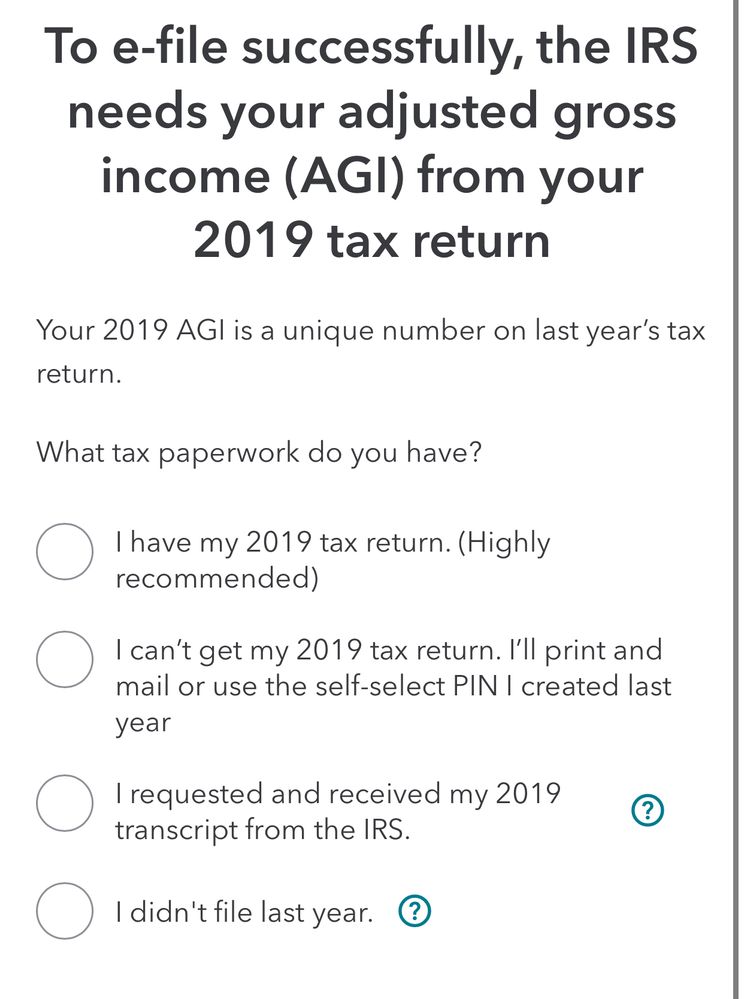

I uploaded the question at the bottom.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@ Niloo201 wrote:Yes, that is referring to efiling. I received the receipt for my 2019 state taxes but there is no information regarding my federal taxes when I check through Check My Refund Status.

I uploaded the question at the bottom.

It's a coin toss. There are a couple of choices in regard to the 2019 AGI question that would have the same end result.

You could choose "I have my 2019 tax return" paperwork (which you do), but when a screen then asks you for the 2019 AGI, do not use the one on the 2019 return. It was filed too late to be in the IRS database. Instead enter a 2019 AGI of 0 (zero).

Or you could choose "I didn't file last year". When that is indicated, TurboTax would likely place the 2019 AGI of 0 for you automatically in the background. What is the help message when you click the blue question mark next to that option? Does it say it will enter a 2019 AGI of 0?

I'd probably go with the first option above, since it's the most technically correct, as long as you enter a 0 for the 2019 AGI. Do NOT use the actual AGI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

- I put the second one and the system automatically put 0 for AGI